The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Of course, the current market environment is one of crisis and very high volatility, and price movements are almost entirely dominated by the economic impact of the coronavirus pandemic. That is the dominant factor to consider in trading any market today.

Big Picture 19th April 2020

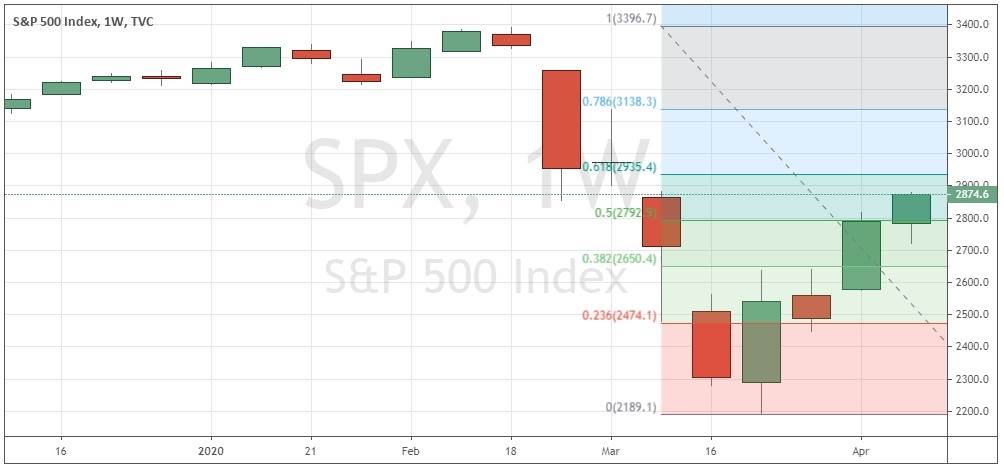

In my previous piece last week, I forecasted that the best trade was likely to be short of the S&P 500 Index following a close at a new 2-day low below 2790. This never happened, so no trade was triggered.

Last week’s Forex market saw the strongest rise in the relative value of the Japanese Yen, and the strongest fall in the relative value of the New Zealand Dollar.

Fundamental Analysis & Market Sentiment

The world is not coming to an end, but we are living in an extraordinary time of global health crisis, the type of which has not been seen in one hundred years. There is a great deal of fear and panic, but it is important to remember that the evidence shows that the vast majority of people are going to survive and be healthy.

In time such as these, it is extremely difficult to make very short-term market forecasts, as the crisis can change focus day by day, strongly affecting sentiment and market movements. However, medium-term forecasts are easier to make as high levels of volatility tend to accompany see-sawing price movement.

We have seen the epicenter of the global pandemic move into the United States, especially New York, with fatalities hitting a high rate also in the U.K. It looks as if this wave may have already peaked in Italy and Spain, the European countries with the highest total death tolls to date.

The U.S. stock market was temporarily boosted by a $2.2 trillion emergency stimulus package. Despite important questions remaining as to the sustainability of this rally even in the face of a huge drop in GDP and employment, last week saw stock markets rise again, boosted at the end of the week by reports that a drug patented by Gilead Sciences may be effective in treating coronavirus.

The rally in stock markets is frankly baffling and seems to make little sense.

It is clear that this crisis will enforce severe economic restrictions in all affected countries which will need to last for several weeks or even months. The only given is that stock markets and GDP generally will take severe hits, with Goldman Sachs now forecasting a 34% drop in U.S. GDP in the second quarter of 2020 and U.S. unemployment topping at 15%. The stock market crash we are seeing is comparable to 2008 and even 1929 so far. In fact, the speed of the initial drop of 20% from the all-time high price took only 15 market days to happen, compared to 30 days in 1929.

The S&P 500 Index has recovered more than 50% of the value of its peak to low move made in February and March. While this may be a sign that we have already seen the low, it should be remembered that the crash of 1929 was followed by an immediate recovery of more than 50% as well.

It seems clear that we will see a continued though maybe reduced level of high market volatility, at least in the stock market.

We are also starting to see a few countries that have had relatively successful lockdown measures begin to relax restrictions on the belief they have successfully dealt with a first wave of infections. These are smaller nations such as Denmark, Norway, Austria, Israel and the Czech Republic.

The U.S. is in a strange situation, with the virus running rampant, and quite possibly even the first wave has not peaked, yet we are seeing the President use rhetoric demanding an economic opening and a politicization of the response to the disease.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows last week printed a near-pin small doji candlestick which rejected the support level shown at the blue horizontal line. This suggests an upwards move is more likely than a downwards move next week, which is reinforced by the fact that the price is higher over both 3 and 6 months. Overall, next week’s price movement in the U.S. Dollar looks somewhat unpredictable but more likely to be up than down.

S&P 500 Index

The major U.S. stock market index – the biggest market index in the world – made an upwards move on declining volatility after falling two weeks, after closing at its lowest weekly close in three years five weeks ago. It is hard not to see further downwards movement as likely over the near to medium term due to the worsening, Great Depression-like situation regarding demand and output in both the U.S.A. and globally. However, it cannot be avoided that the price action remains bullish and the price has regained more than 50% of its recent decline, both of which are bullish signs. On the other hand, the price retraced more than 50% of its initial decline after the stock market crash of 1929, so it may be that the 61.8% retracement zone shown in the chart below at about 2925 will be an area at which we could see a major bullish reversal.

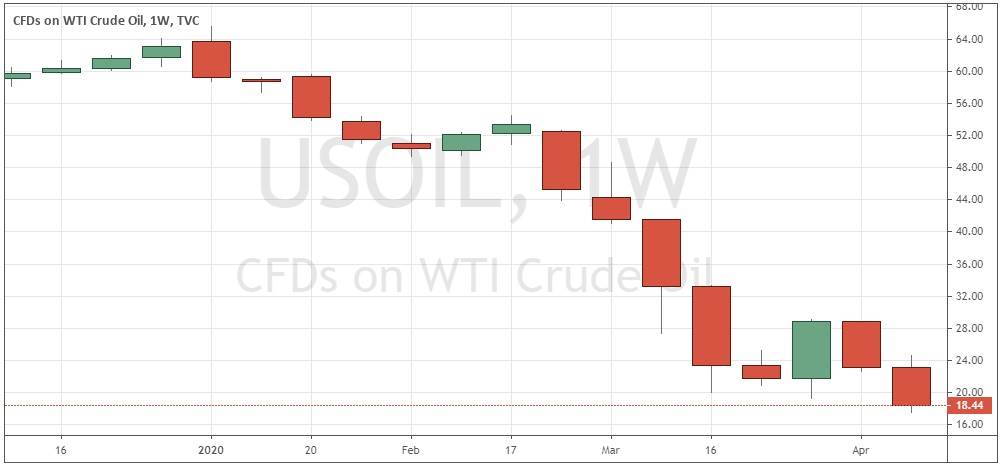

WTI Crude Oil

WTI Crude Oil made a relatively strong bearish move last week, falling by about 20% in value to a new low below $20, making its lowest weekly close in 18 years. It is interesting that although stock markets are rising, oil is falling on lower demand due to the coronavirus pandemic. It is always risky to short commodities at historic low prices, but the price may fall further over the next week, as it reflects quite strong bearish momentum.

GOLD

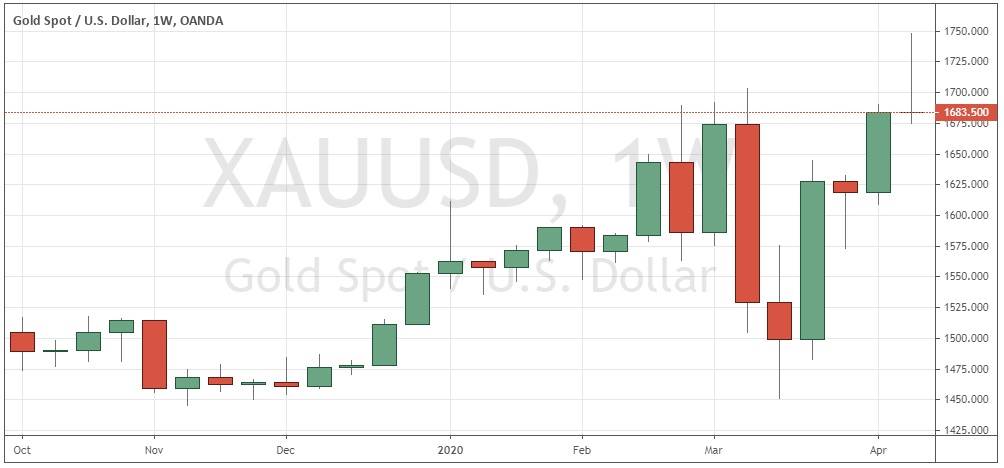

Gold made a strong upwards movement last week, reaching new multi-year high prices near $1750, before falling back to end the week with a pin candlestick. Although this is often a bearish indicator, the price is only three days off its high and is more likely than not to recover. The coronavirus pandemic is arguably leading to the debasement of almost all currencies, so it makes sense that Gold will be a good long trade. However, I want to see some bullish price action on Monday before making any long trade entry.

Conclusion

This week I forecast the best trade is likely to be long of Gold in USD terms if it closes up at the end of Monday’s New York session compared to last Friday.