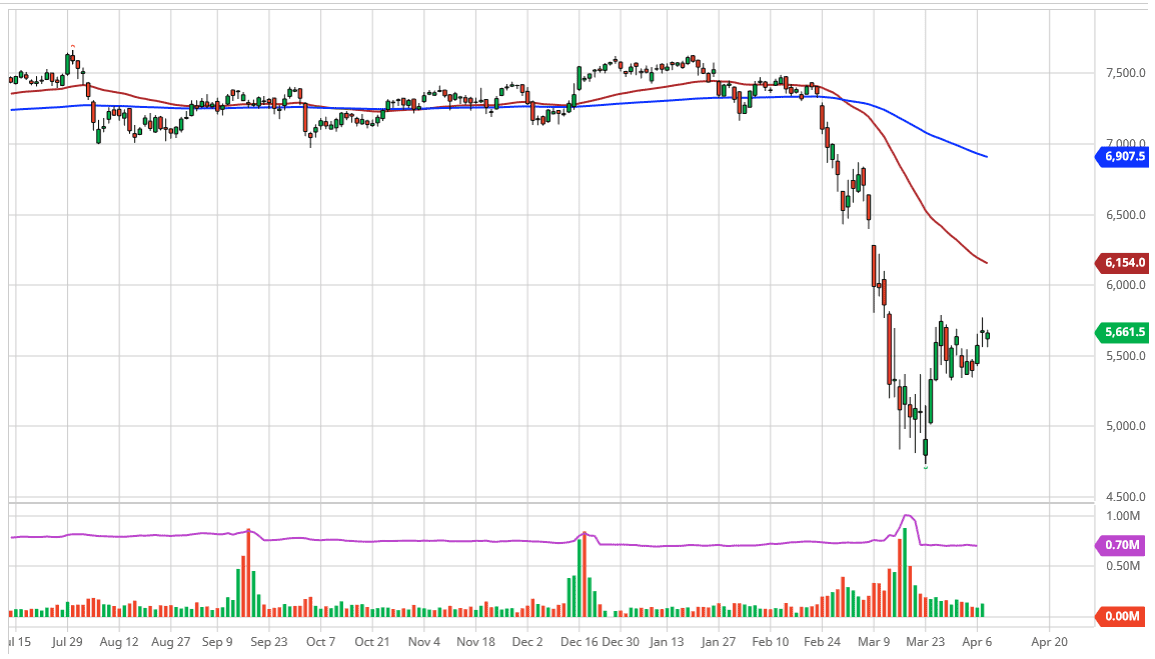

The British stock markets had a choppy session on Wednesday as we continue to try and discern whether or not stocks in general can go higher. Having said that, the markets continue to find trouble at the 5750 level in the futures contract, as you can see over the last couple of weeks. Ultimately, this is the stock market that is trying to find its footing and perhaps a potential break out, and if we can clear this little area just above, the next target would be of interest as the 6000 handle.

Having said that though, the 5750 area is the scene of a small gap lower, showed that is one of the main factors in resistance. With that being the case, I think that you will probably continue to see a lot of back and forth choppiness, but with a bit of bullish pressure underneath. However, there is always the alternate scenario which of course we need to look to as although there is always the possibility that the market selloff due to some type of ugly headline.

If the market were to break down below the 5250 handle, it almost certainly will open up the door down to the 5000 level which of course has a certain amount of psychological importance attached to it. Beyond that, there is also a massive gap down at that area that will attract a lot of attention for support anyway, so buying down at that level would be seen quite a bit, all things being equal and “market memory” coming into play.

At this point, you should also keep in mind that there is a gap above which is sitting just below the 6500 level, so that has to be filled as well. In other words, you can expect a lot of back and forth and choppy behavior as people have no real idea what to do with themselves right now. The central banks around the world continue to stimulate economies, and one would have to think that money will eventually flood into stocks because of the lack of yield anywhere else. The FTSE 100 may be one of those scenarios as well. At this point though, the 5750 level is the top of the current range, with the 5250 level offering the bottom of that range. Expect a lot of noisy behavior between those two levels as the market builds up inertia.