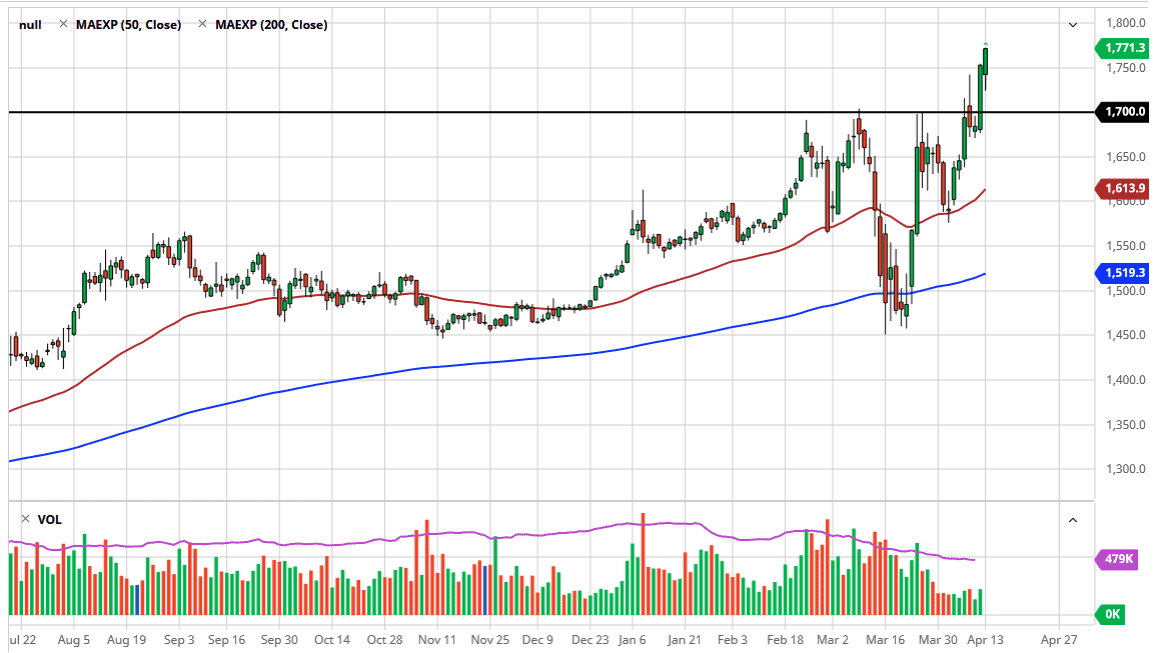

Gold markets continue to offer a bit of a safe haven for traders around the world as it initially dipped to kick off the week on Monday, but now has clearly busted beyond the $1750 level. At this point, it looks very likely that the gold market is to go looking towards the $1800 level. That’s an area that I think will attract a certain amount of attention but in the end, I believe it is simply just a stop on the way to the $2000 handle which will be much more significant in its importance.

Ultimately, the market pulling back from here makes a bit of sense because we are getting extended, but that doesn’t necessarily mean that it has to. The one thing that I do know is that I have no interest in trying to short gold, because there are so many moving pieces out there that will continue to have traders looking for the safety of owning gold. Beyond that, the Federal Reserve is flooding the market with US dollars, and that of course should help lift the value of the gold market itself as it is priced in the same currency.

Don’t be wrong, not tan that we can’t pullback, but I think that the area between $1690 and $1700 will continue to offer a bit of a “hard floor” for the market. Pullbacks to that area should be thought of as value, assuming we can even get there. If you can trade small enough, a breakout above the $1750 level is enough to get buyers involved as well. However, keep in mind that headlines around the world will continue to throw markets around, then by extension the gold market itself. It the current moment, the market is likely to see a lot of volatility based upon the latest coronavirus numbers. Furthermore, with the Federal Reserve and central banks around the world liquefy the markets, it makes sense that gold would rally in that environment as fiat currencies will lose value. We are in an uptrend, and therefore there’s no need to try to fight been short gold. Even though there had been at recent sharp pullback, that was more about liquidation because of margin calls in the stock market. We are well beyond that, so there’s no reason to think that it’s going to come back with any type of vengeance at this point. However, if the stock market meltdown that could cause another scenario like that.