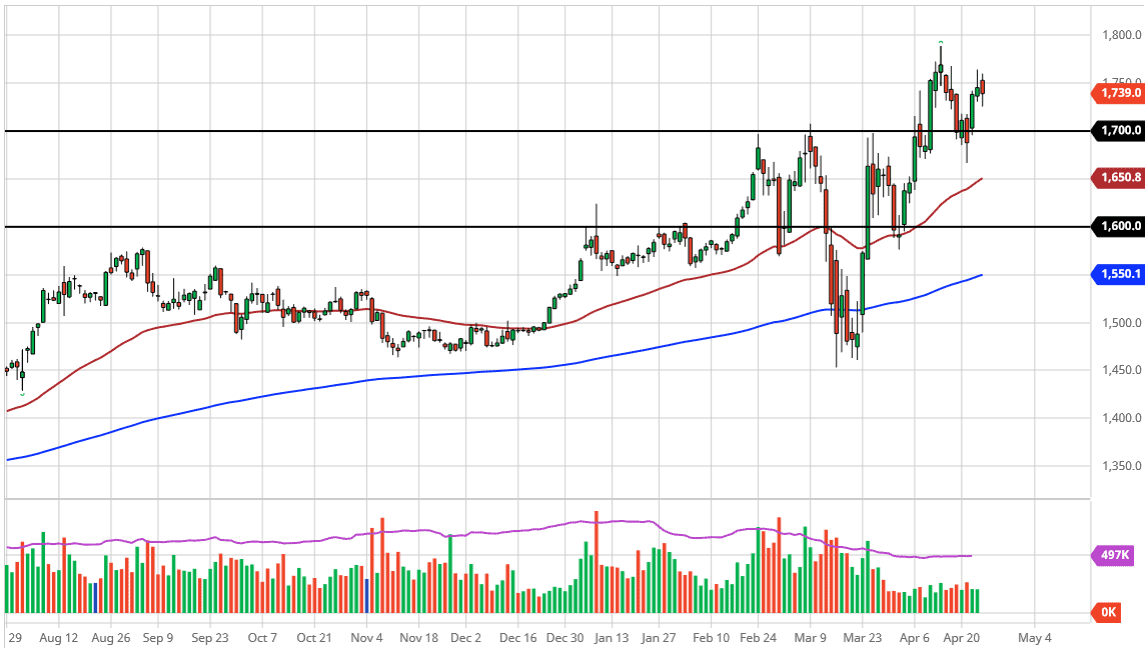

Gold markets went back and forth during the trading session on Friday but ultimately settled on a negative candlestick. That being said, the market looks likely to see a lot of support underneath and I think this is simply a matter of people taking profits into the weekend, and perhaps even a serious lack of volume overall when it comes to the financial markets. After all, the top of the candlestick was towards the top of the shooting star from the previous session on Thursday, so that suggests that we are going to see a bit of selling pressure in that area.

If we break down from there, it is likely that the market goes down to the $1700 level which should offer plenty of support. At this point, it is highly likely that the market is going to find plenty of buyers in that area to add to a position. Gold should continue to go much higher, due to the fact that the central banks around the world continue to flood the market with cheap money, and that of course is good for gold over the longer term as fiat currencies lose value. Beyond that, we have the safety trade, as there are a lot of concerns out there about economies around the world being locked down. Gold should perform quite well due to both of those reasons, but you cannot expect it to go straight up in the air forever. Because of this, this pullback will probably continue to attract buyers, as you can build up your position, or if you are not involved in gold at all, you may feel it is time to get long.

I believe $1700 begins about a $50 support level, and it should be noted that the 50 day EMA is currently at the $1650 level and therefore I think that we will see a lot of support in that area. Alternately, if we break above the top of the shooting star from the Thursday session, we could go towards the highs again, but we need some type of shock to make that happen. As we head into the weekend though, anything is possible so we will have to see whether or not there is a gap higher to kick off the week. I doubt that going into the close, so I am more of the mindset of buying the pullback, but I would be flexible enough to buy this market if it gaps to the upside at the open.