Gold markets pulled back a bit during the trading session on Monday to continue to show weakness. That being said, the market has been a bit overextended, so the pullback is not a huge surprise. Furthermore, a lot of traders out there start to focus on the fact that economies are going to be opening up again, and therefore they want to put more of a “risk on” type of trade out there. This works against the value of gold, at least in the short term.

All of that being said, the reality is that there are still plenty of concerns out there, so it makes sense that gold will rally over the longer term. One of the most serious concerns is the fact that the Federal Reserve continues to pump liquidity into the system, thereby suggesting that we are going to see inflation eventually. That should be like a rocket fuel for the gold market. Furthermore, gold can be used for safety when it comes to an extremely negative market, so the fact that there are a lot of concerns out there economically does drive up the idea of gold offering the so-called “safety trade.”

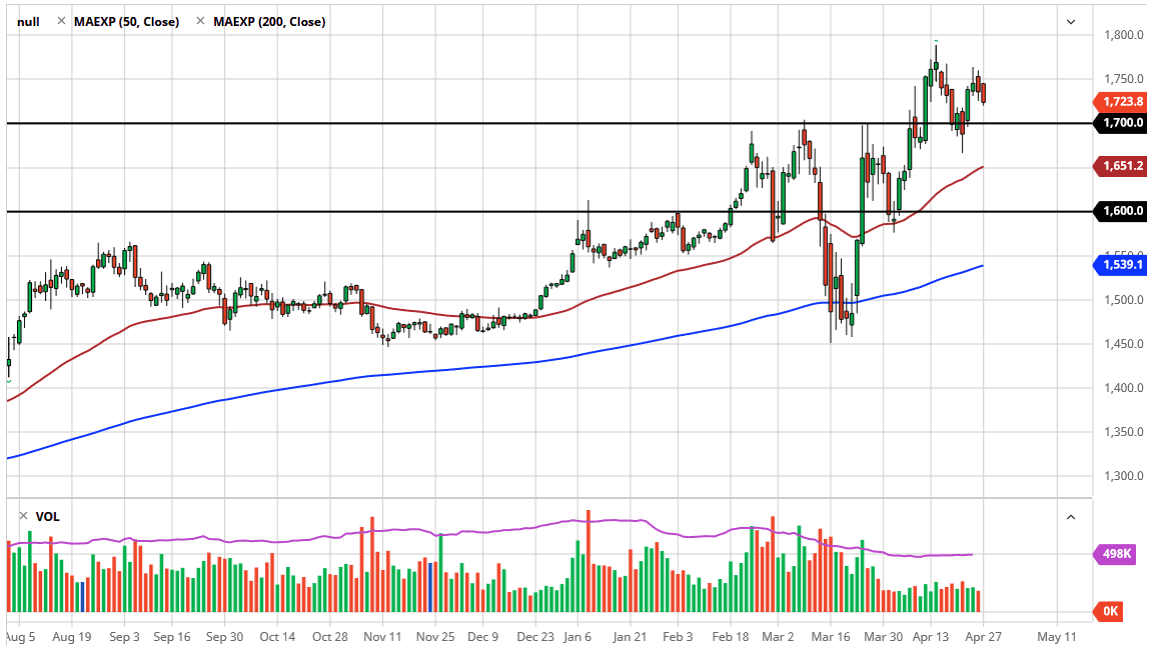

The most obvious support level underneath is the $1700 level, but I also think that it is essentially a zone that extends down to the $1680 level. Underneath there, I recognize that the 50 day EMA, which is currently sitting at the $1650 level, should offer a bit of support as well. As long as we can stay above that level, I think that this market has a good shot at continuing the overall uptrend, going towards the highs again. In fact, I think that the market will then go looking towards the $1800 level, perhaps even the $2000 level given enough time.

If we were to break down below the $1600 level, that could change a lot but I anticipate that if we do see the market break down like that, it makes sense that the reason might have something to do with covering margin calls in other markets like we have recently seen. Unfortunately, that wrecks the gold market, because traders will be taking gains here to pay for losses in other markets. As they get margin calls in their stock position, a lot of large funds will take in all the profits they can in order to protect those positions and build up even more margin. That being said, if it were to happen, it should only offer a buying opportunity eventually.