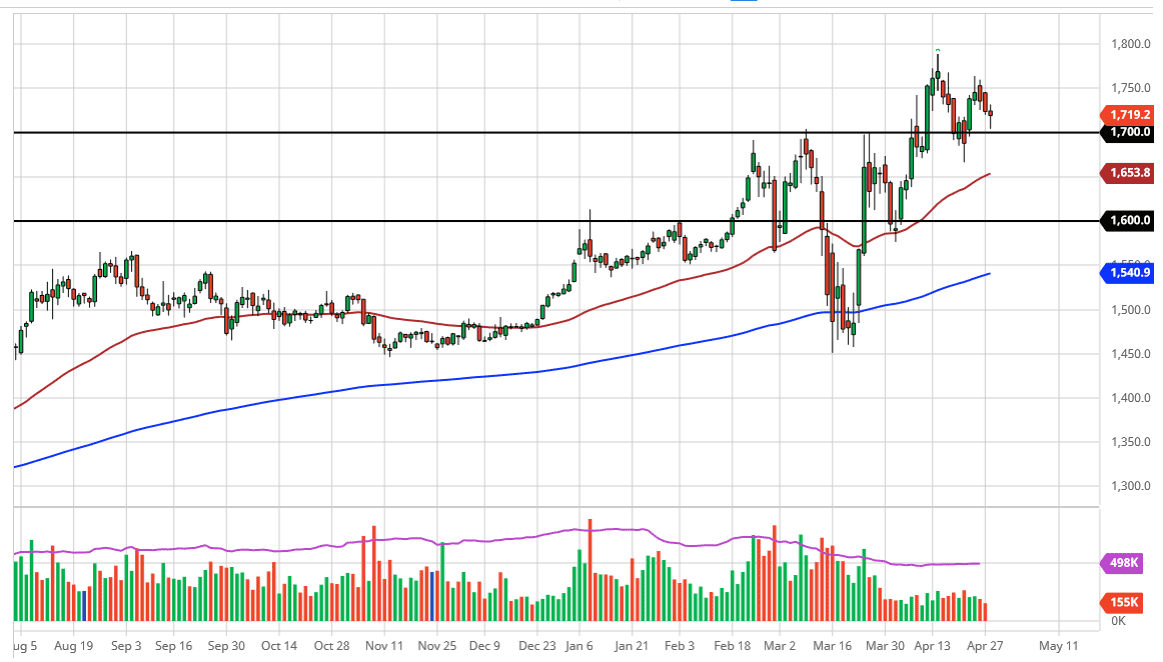

Gold markets continue to see buyers underneath, as it has seen selling pressure at the open on Tuesday but have also seen futures traders get long just above the $1700 level. This is an area that of course has a lot of psychological importance to it, and therefore it is not a huge surprise to see buyers jump in and push this market. Ultimately though, this is a market that forming a hammer makes quite a bit of sense and should continue to send this market towards the $1750 level.

All things being equal, I think that there is a significant support level down to the $1680 level, so I do not have any interest in shorting even if we do break down below the $1700 level. After that, the 50 day EMA comes into play and should offer support as well, as it is reaching towards the upside and has been to find the trend higher. At this point, gold market should continue to rally based upon fear if nothing else, and of course the softening US dollar has helped a bit recently also.

The $1800 level above is the short term ceiling, but I do believe that it is only a matter of time before we break above there. Once we do it opens up the door to the $2000 level, and quite frankly I think one of the biggest trends that we are going to see over the next several months if not years is going to be gold rallying, not only due to the global fears around economics, but the fact that central banks around the world are flooding the markets with liquidity. That could drive inflation into the picture, which of course will help gold given enough time. This does not mean that there will be the occasional pullback, but the reality is that it is only a matter of time before we continue what has been an exceptionally reliable trend. Recently, the gold market had sold off rather drastically but that was more about margin calls in other markets than anything to do with gold itself. Watch what the Fed says on Wednesday, that could greatly influence where gold goes next as well, because it will more than likely move the US dollar quite drastically if recent activity has been any sign of the way the markets have been skewed towards massive volatility.