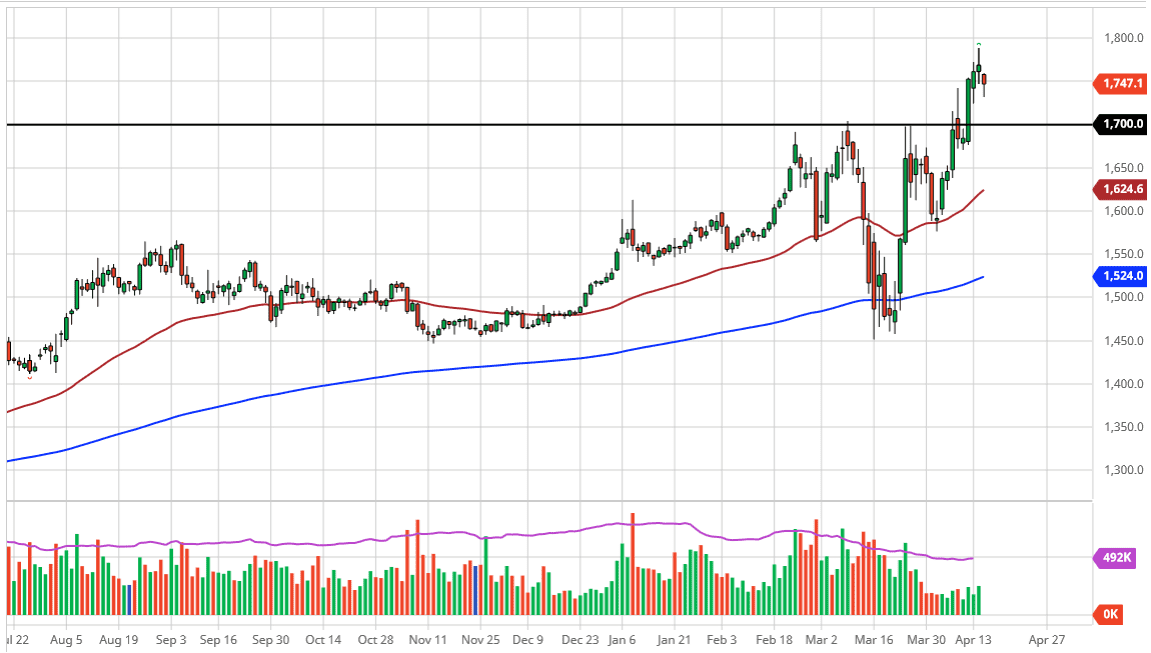

The gold markets have fallen a bit during the trading session on Wednesday, pulling back towards the $1732 level, before finding buyers to turn around and form a little bit of a hammer. That being said though, don’t be surprised if we pull back further to find an even more significant support level.

Gold markets have paid close attention to the $1700 level underneath, which of course is a large, round, psychologically significant figure and an area where there had been resistance previously. If we can hold that level, then it’s likely that we continue to go much higher, due to the fact that the central banks around the world continue to throw money in the bond markets and the like, and therefore it’s the same thing as quantitative easing. If that’s going to be the case, then it makes quite a bit of sense that the gold markets will continue to attract money for a way to avoid the potential inflation down the road.

Furthermore, gold also is very sought after when it comes to safety. I think that is going to continue to be the name of the game in the meantime. In fact, I believe that the $1700 level extends down to at least the $1690 level underneath, so therefore that entire “block of support” is something that we should pay attention to. In fact, I have no interest in trying to short this market anytime soon, but I would be paying close attention to the 50 day EMA underneath which is colored in red on the chart. That of course is an area that typically attracts a lot of attention by technical analysis users, and of course the fact that it defines the trend in general.

If we were to break down below the 50 day EMA then it could change quite a bit but at this point I think it’s very difficult to imagine that we are going to do that anytime soon. The one caveat could be further gold selling to raise money for margin calls that could happen in the stock market. That being said, that’s the only bearish case I have for gold in the short term, so I would look at something like that as a potential buying opportunity. I will keep you up-to-date here at Daily Forex as to whether or not I think something like that is going on.