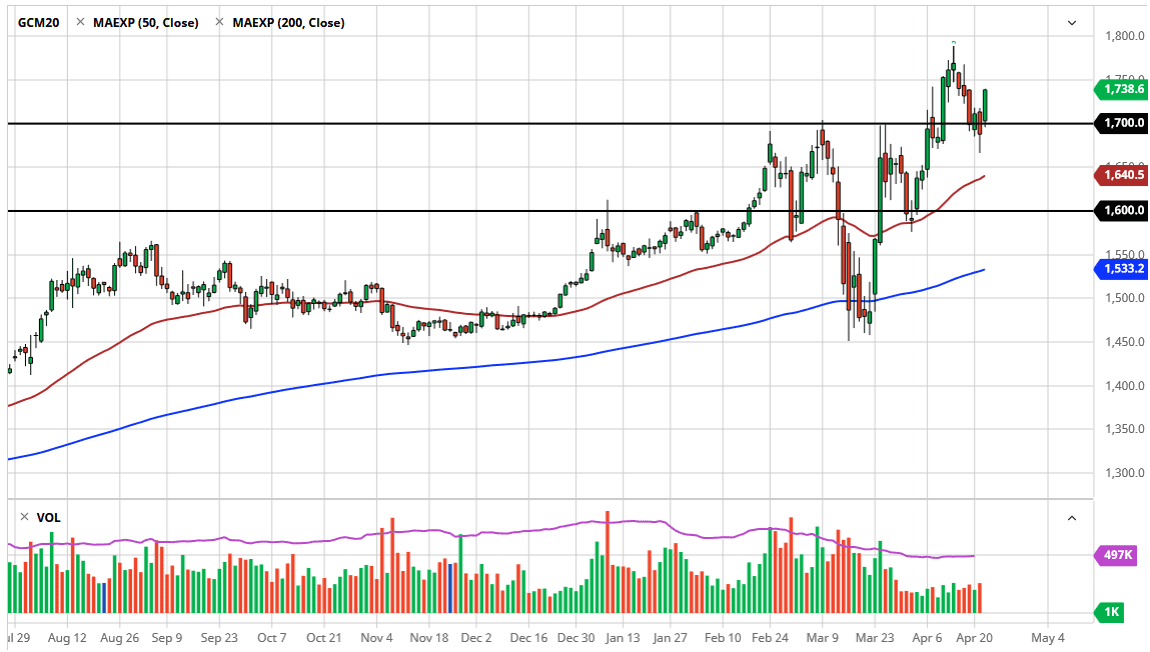

Gold markets rallied significantly during the trading session on Wednesday, as we have broken above the top of the hammer from the Tuesday session. More importantly, the market found the $1700 level as supportive, an area that is a large, round, psychologically significant figure, and therefore it is something that you should pay attention to. The area was the previous resistance level, so it now should function as a bit of a support level. We have already seen that happen during the trading session on Wednesday, and now the market has reached as high as $1740. At this point, the market has pulled back just a little bit, and I think the $1750 level will offer a certain amount of resistance as well. If we can break above that level, then we will probably tackle the highs.

Keep in mind the gold is rallying due to a lot of issues, not the least of which would be the fact that there is a lot of concern about the global economy out there. Gold is considered to be a safety trade, so by going higher it shows that there is still a lot of concern out there, despite the fact that stocks rallied during the same session. Sometimes, gold can give you a bit of a “heads up” as to what a certain segment of the trading population actually feels.

The candlestick for the trading session on Tuesday should be thought of as a significant bullish candle, so if we were to break down below it that would show significant bearish pressure but I still believe that the 50 day EMA will be paid close attention to which is just below it. That currently sits at the $1640 level, so therefore I am going to use it as a bit of a dynamic floor. I do believe that eventually we break out to the upside and go looking towards the $2000 level, but it is going to take some time to get there. With all of the concerned about global growth dropping off of a cliff, it makes sense that traders are going to be using gold to protect their wealth. All things being equal, this is a market that should continue to be bullish, but we may get the occasional pullback that you can take advantage of to pick up a bit of gold along the way, building a larger position