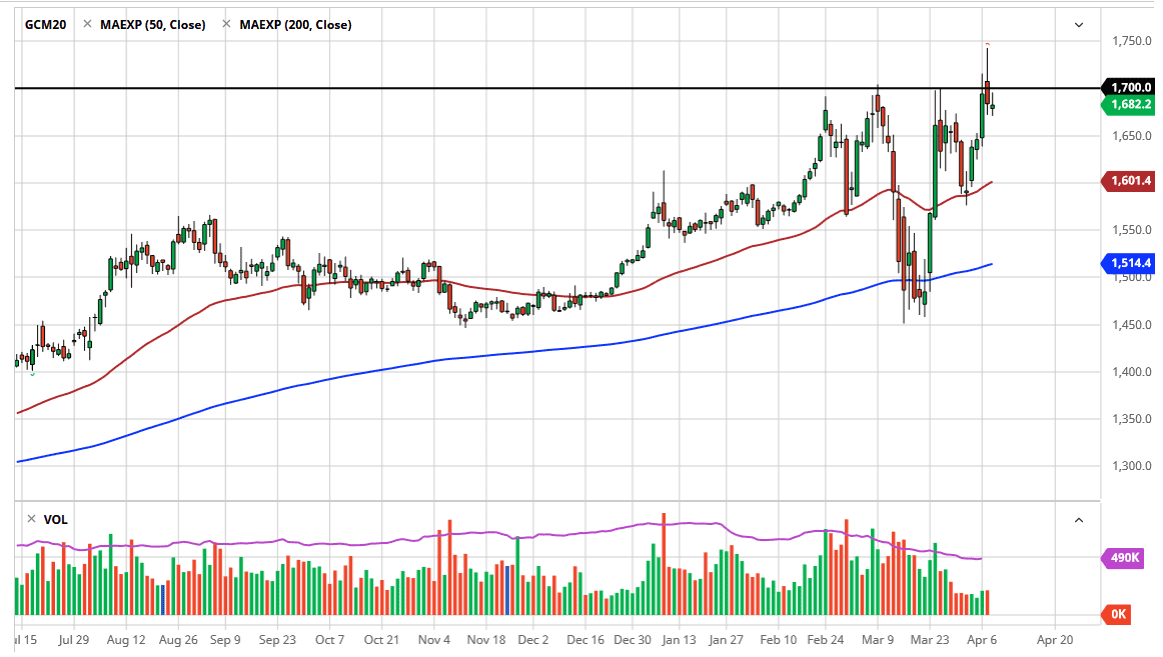

The gold markets went back and forth during the trading session on Wednesday, showing signs of exhaustion after breaking through the $1700 level during the previous session. Nonetheless, there is a lot of interest in gold so I think that these dips will continue to attract a certain amount of inflow. The monetary flow most certainly has been into gold, not away from it, and therefore I think it will continue to attract more people.

If we were to somehow break above the top of the shooting star that formed during the previous session on Tuesday, that would obviously be a very bullish sign and should have the gold market going much higher. Breaking above the top of that bearish candle, you will have wiped out everybody’s shorts, and therefore you should see a short covering rally as well. At that point I would anticipate the goal goes looking towards the $1800 level, perhaps even followed by the $2000 level after that.

At this point, the market has plenty of support below, especially near the $1650 level and the $1600 level which is currently hosting the 50 day EMA as well. In that scenario, there are plenty of support levels that could come into play on any type of pullback so therefore I don’t want to get short or bearish. Central banks around the world throwing money around is of course going to continue to drive that the idea of gold higher anyway, and with the global pandemic there is also a bit of a “safety trade” here as well. In other words, the fundamentals for gold remain very good, although it is a little bit of a thin market, so it does pull back rather quickly.

It’s not until we break down below the $1600 level that I would consider shorting this market, and even then, I’d have to be convinced of it. I believe that the trend is still probably to the upside until we break down below the 200 day EMA underneath. Ultimately, I think we are going to get an opportunity to pick up gold at a cheaper level, and I will approach the market as a “buy on the dips” type of trader going forward. That being said though, if we did break above the top of the shooting star from the previous session, that could be a sign of increasing bullish pressure and the move could be relatively quick.