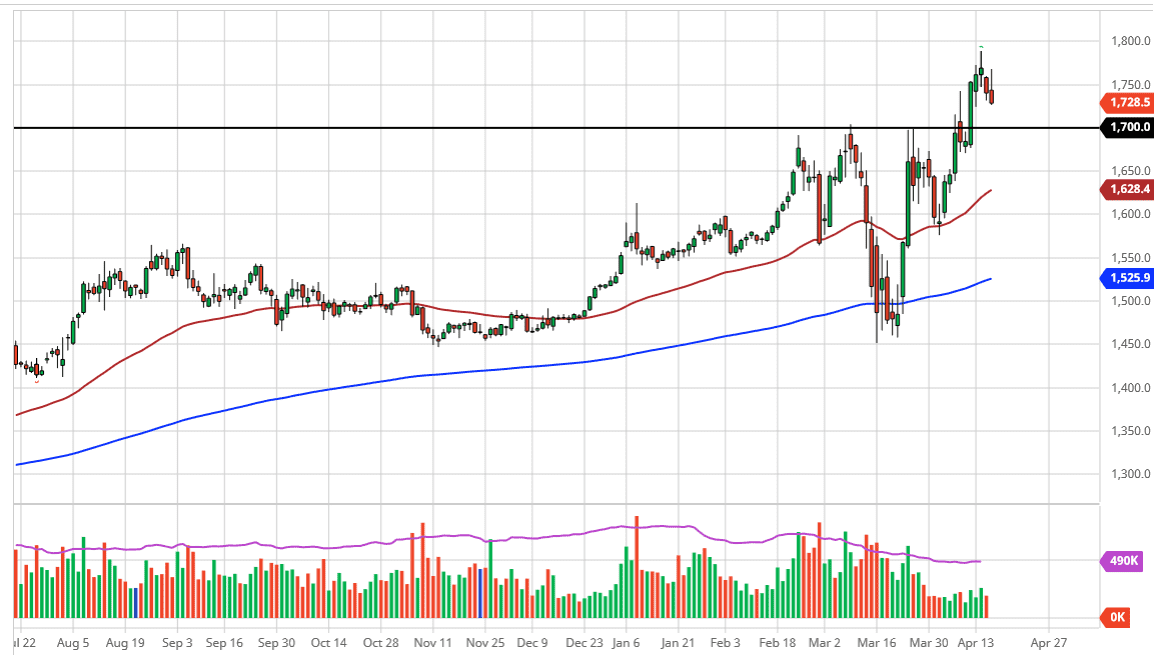

Gold markets initially tried to rally during the trading session on Thursday but gave back the gains to form a rather ugly candlestick. In fact, we break down pretty significantly and then bounced again to form a bit of a shooting star shaped candle. The gold market certainly looks as if it is trying to “top out” in this area, although I’m not willing to suggest that the trend is over, simply that we are going to get a bit of a breather at this point.

The most obvious level of potential support would be near the $1700 level, as it is a large, round, psychologically significant figure. Beyond that, we also have the $1680 level which I think is the bottom of the overall range, at least as far as the support is concerned. We are very much in an uptrend and I don’t plan on fighting that anytime soon. This isn’t to say that we can’t pull back, let alone break down. We saw this previously, due to profitable trader’s closing out positions in order to cover margin calls in other markets like the S&P 500. Because of this, it’s likely that the market could get a little bit of a boost after breaking down significantly again. Nonetheless, I do think that the 50 day EMA will also offer support so it’s not until we break down below there that I’m even remotely concerned about the uptrend.

The bearish case could be that we are forming a rising wedge, but I think that is a little bit of a stretch at this point. The alternate scenario of course is that we break above the highs of the trading session on Thursday, sending this market to go looking towards the $1800 level. Above there, I would be looking for a move towards the $2000 level over the longer term. I like gold and have been buying on dips. That being said, it certainly looks as if we are going to drop a bit in the short term, if for no other reason than to pick up a bit of momentum going forward. Expect a lot of volatility, especially going into the weekend as traders will be looking to cover profits and of course will probably try to be neutral over the course of the weekend as the latest headline cycle could move the markets quite violently at the open on Monday.