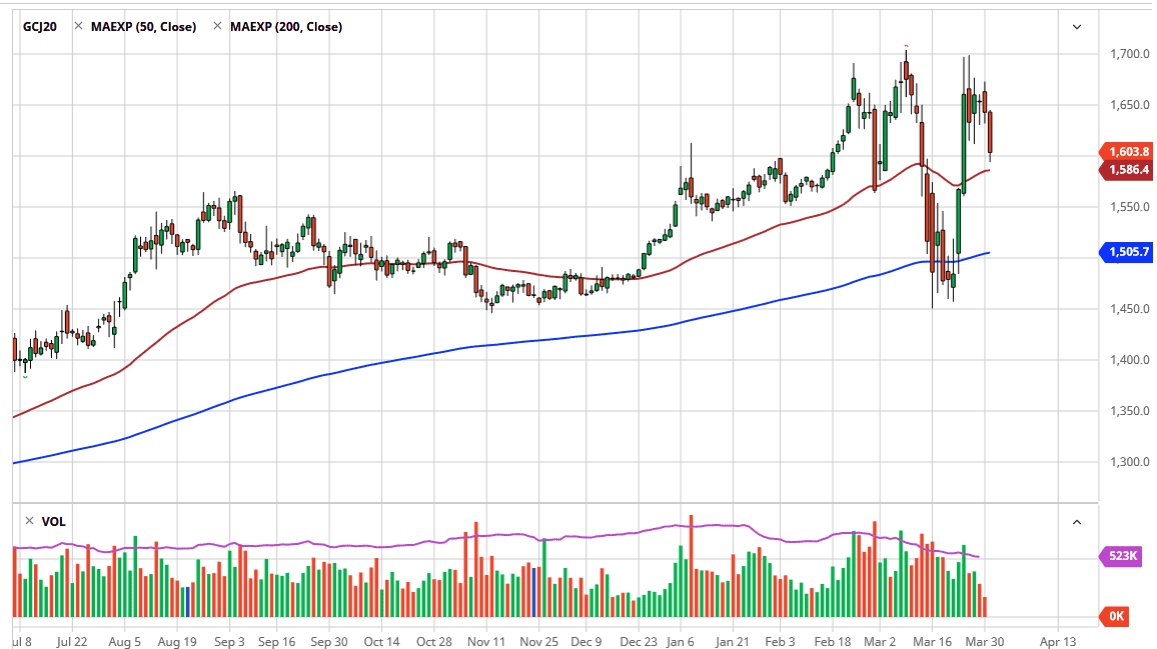

The gold markets have fallen a bit during the trading session on Tuesday, reaching down to the crucial $1600 level. This of course is a large, round, psychologically significant figure, and also features the 50 day EMA. There has been a significant amount of support recently, so it should be noted that in this area buyers continue to stick to gold. That doesn’t mean that we can break down, but it does mean that a potential bounce is coming.

That being said, if we do break down below the 50 day EMA it’s likely that we will first attack the $1550 level, followed by the $1500 level underneath which is basically where the 200 day EMA is. Either way, I don’t have any interest in shorting gold because I believe that it’s only a matter of time before gold rallies due to the global fear that’s out there. Granted, there is no such thing as inflation right now, but the reality is that central banks around the world continue to loosen monetary policy in a whole plethora of ways, and eventually this does cause gold to rise.

If we do turn around a break above the $1700 level, the market is likely to go looking towards the $1800 level next. That being said, if the market does break to that level it’s probably only a matter of time before it goes looking towards the next major psychological barrier, the $2000 handle. That’s actually my longer-term target but I recognize it’s going to take quite some time to get there. I would also point out that the daily candlestick isn’t exactly bullish, considering that it broke down to close towards the bottom of the range. That being said though, the market is very noisy in general and I think at this point the most important thing you can do is keep your position size relatively small.

If we were to break down below the $1500 level, then that could signify that the uptrend in gold is over. There are plenty of issues out there that will continue to be a major problem for traders around the world, and at this point it’s likely gold will continue to at least keep somewhat of a bid. Look at pullbacks as value but keep your leverage as low as possible as this could be a very bumpy ride regardless of the direction, we go over the next few weeks.