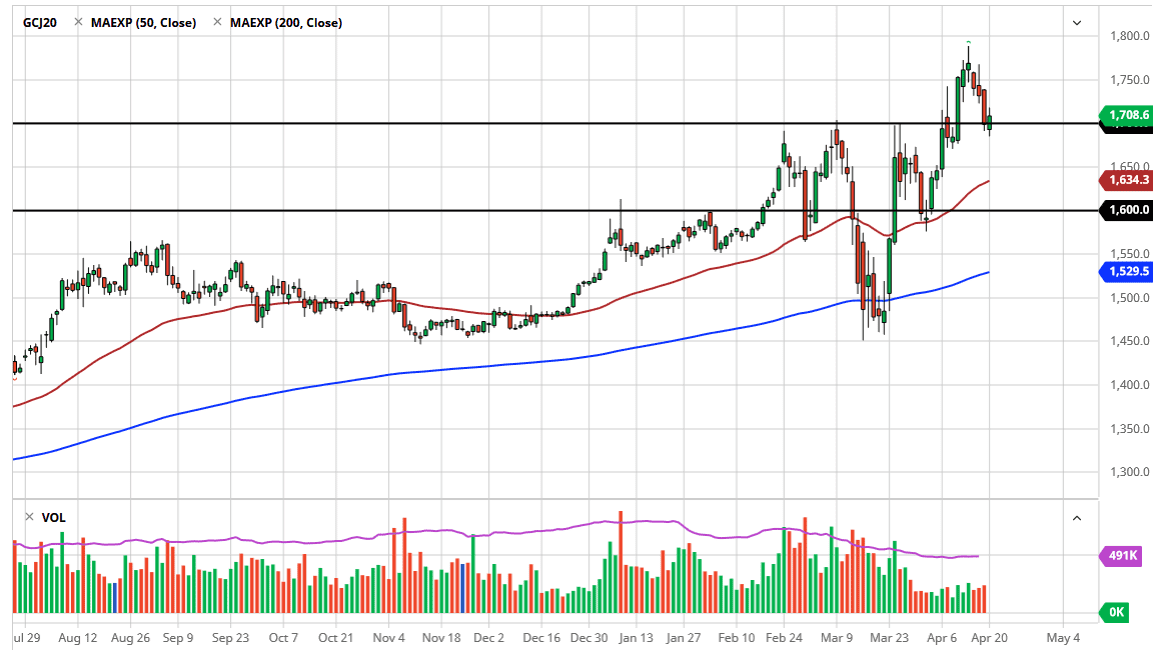

Gold markets went back and forth during the trading session with a positive tone on Monday, as the $1700 level of course offers quite a bit of psychological importance. Furthermore, this is also an area where the market has seen a lot of resistance previously, so it makes sense that it is simply a case of “market memory” more than anything else. At this point, even if we do break down from here, there is also supported to be found at the $1650 level, which is essentially where the 50 day EMA sits.

With all of the negativity out there, it’s difficult to think that gold will fall for too long. At this point, the market has been in a major uptrend for quite some time, so therefore there is much more interested in the upside than down as you can see, and as a result we should continue to see this market try to reach towards the $1750 level, followed by the $1800 level. A move above there then opens up the door to the $2000 level given enough time.

As the week started, it’s obvious that there are still plenty of things out there to worry about. Ultimately, this is a market that should continue to see plenty of interest, because there are so many problems out there involving several central banks around the world dumping liquidity into the marketplace, causing major weakness with fiat currencies on the whole. I don’t think that changes anytime soon, so having said that it’s very likely that the gold markets will be a place that people run towards.

At this point, if we break above the highs of the Monday session I think that’s a good sign that we are going to go to the upside again, and regardless of what happens next, I think you’re going to be very hard-pressed to find an opportunity to sell this market for anything more than a scout, which makes no sense when you look at the overall move. By being patient and waiting for value, you should be able to find plenty of opportunities in this market to the upside. Furthermore, it seems as if there should be a steady slew of negative news out there to have gold will rally going forward. About the only thing that’s working against the value of gold at this point is the strength of the US dollar.