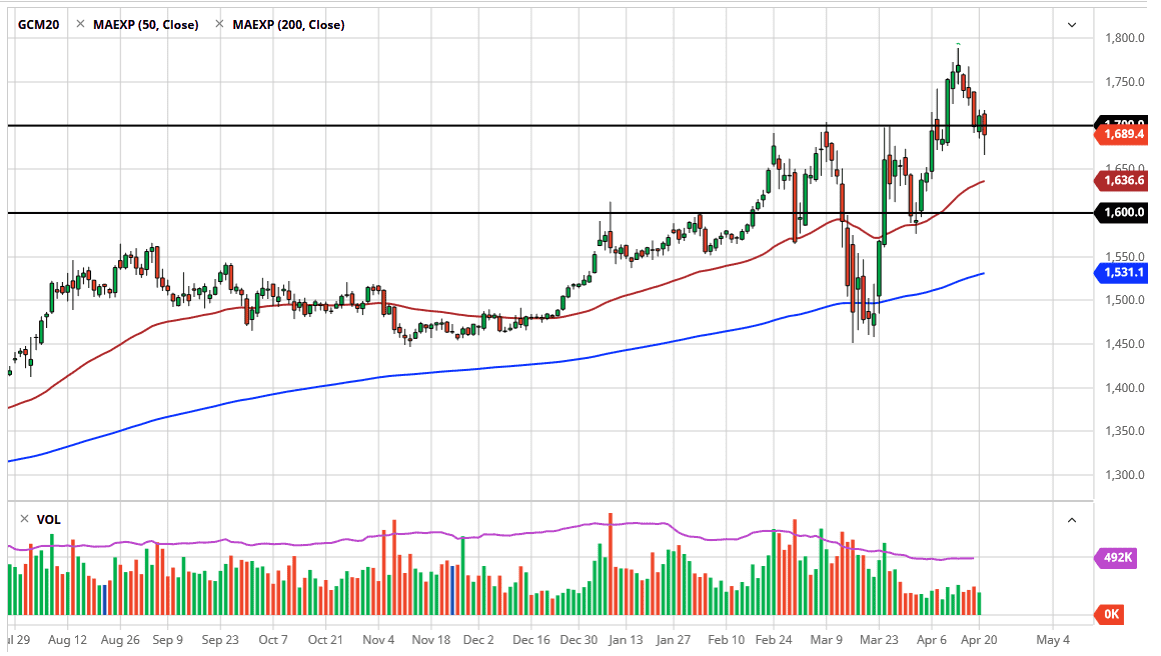

Gold markets are more than likely going to continue going higher after the action that I have seen in the market on Tuesday. After all, the market pulled back quite drastically but found enough support near the crucial $1670 level to turn around and bounce back towards the $1700 level. The resulting candlestick is a hammer, which is something that catches a lot of attention, and a lot of traders will be paying attention to this. Looking at this chart, it is obvious that if we can break above the highs of the trading session on Tuesday, then it is likely that we go looking towards the $1740 level, and then eventually the highs that we had made.

I like the idea of buying short-term pullbacks in gold as I have been saying, because quite frankly there are far too many reasons out there to think that gold should continue to go higher. There is a lot of concern out there and of course the safety trade in and of itself should keep gold somewhat elevated. Furthermore, central banks around the world are of spending like drunken sailors, so therefore you should see gold continue to attract a lot of attention for that reason alone.

We are probably heading into a deflationary time coming forward, and that is not as strong for gold as people think. There are going to be massive calls for extreme inflation that should send gold to the moon, but I do not think we are going to see that anytime soon. Because of this, although gold is very bullish and I think that it eventually climbs towards the highs and then the $2000 level, the reality is that it is going to take some time to get there. However, we are grinding to the upside and I think that continues to be the way going forward. In fact, I believe that even if we did break down below the candlestick for the Tuesday session, something that would typically be an extremely negative sign, I would anticipate seeing the 50 day EMA offering support underneath. Below there, then you are looking at the $1600 level as the next likely support barrier as well. In other words, it is only a matter of time before value comes back into the equation and people start buying gold again. Short-term “buying the dips” type of trading is more than likely going to be the most profitable way, but you’ve course can buy-and-hold as well.