Gold markets rallied significantly during the trading session on Thursday, breaking the top of the neutral candlestick from the Wednesday session after the horrific initial jobs claims came out. This had people looking for safety, which of course helped gold. The $1650 level of course offers a significant amount of resistance, but it extends all the way to the $1700 level. I think there is a lot of noise in that general vicinity, that being broken above would be a huge bullish sign.

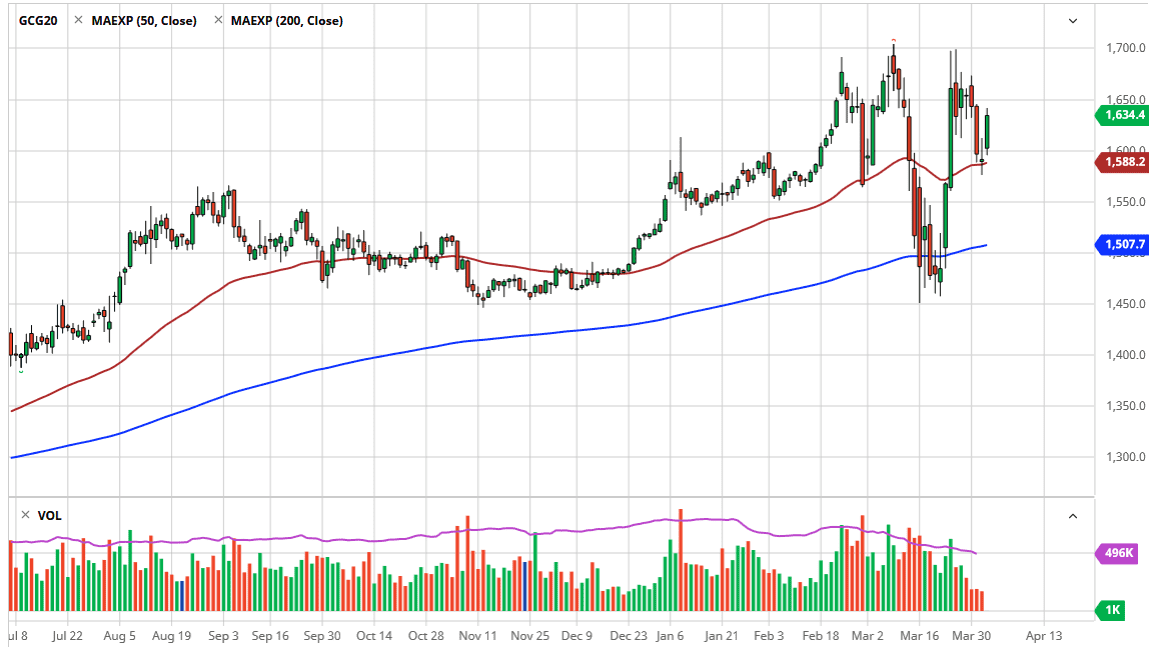

If we do break above the $1700 level, it’s very likely that the market goes looking towards the $1800 level before trying to get to the $2000 level after that. After all, this is a market that has been very bullish from the longer-term standpoint, because there is a lot out there to fear. The US dollar has been relatively strong so that of course has hurt the momentum of gold itself. After all, the market is likely to see buyers on dips, and it does look like the 50 day EMA is starting to offer support. Even if we were to break down below there, the 200 day EMA underneath there should offer plenty of support as well. It’s sitting near the $1500 level, an area that of course is a large, round, psychologically significant number.

Regardless, I have no interest in shorting this market because gold is certainly going to be in demand when safety is paramount. Ultimately, it’s difficult to imagine a scenario where gold sold off drastically, although we recently had seen that everything happen due to the fact that larger funds were selling their profitable positions to get coverage for margin calls in other parts of the world. At this point, the market is likely to see volatility, but at this point I’m looking for opportunities to pick up gold “on the cheap.” You could even make an argument for the idea of the market volatility picking up even further. I think at this point it’s almost impossible to short the gold market because it has started to form an inverse head and shoulders, which makes a measured move towards the $1950 level, and beyond. Either way, there are plenty of reasons to think that this market should continue to find traders interested in this market. One would have to think that it’s only a matter of time before some negative headline comes out to cause issues here.