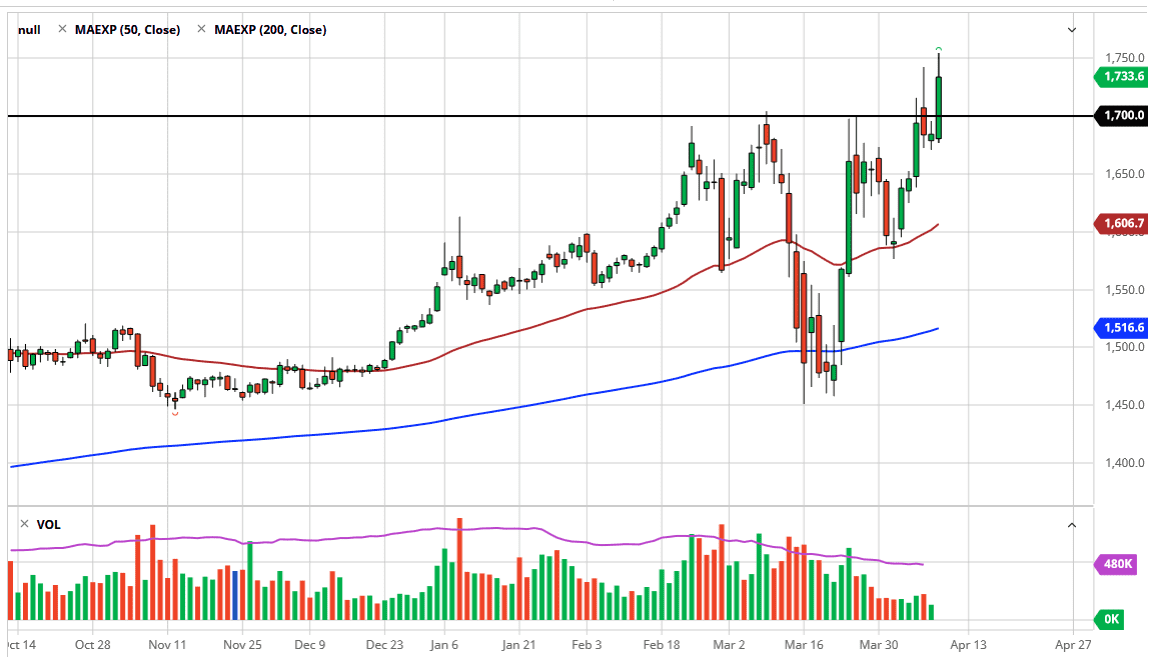

The gold market has rallied a bit during the session on Thursday to make a fresh, new high and has even broken above the $1750 level at one point in the forward contract. That being said, we have pulled back slightly, and I think this shows that although we are going to go higher over the longer term, it’s not going to be in a straight line in clearly it’s going to be volatile but and the end of the day that’s all we have seen anyway and most markets, volatility.

The strength of the candlestick is that we are closing in the upper half, but it also shows that a little bit of the giveback will probably be a major problem. Underneath, I would anticipate that the $17 level should offer plenty of support, and as a result it’s likely that there should be buyers underneath, based upon the large, round, psychologically significant figure and of course the scene of previous resistance. “Market memory” dictates that there should be a certain amount of interest in this area so pay attention to it. However, if we were to break down below the $1675 level, the market will probably go looking towards the 50 day EMA underneath which is currently near the $1600 level.

To the upside, if we can break above the highs of the trading session during the day on Thursday, then it opens up the door to the $1800 level, possibly even the $2000 level. Ultimately, this is a market that has been in an uptrend for quite some time, and therefore there is no reason to start shorting this market. All things being equal, it’s very difficult to sell this market, because quite frankly there are so many buyers and reasons in this market to keep the gold market going higher. After all, the central banks around the world continue to liquefy markets, not the least of which would be the Federal Reserve which announced a $2 trillion stimulus package again during the trading session on Thursday. At this point, not only do we have the problem with the central banks around the world, but we also have a lot of fear when it comes to the economic situation and the global demand for economic activity in general. With that being the case, gold should continue to function as a safety currency beyond anything else.