After three consecutive trading sessions in which gold prices was corrected downward to $1692 an ounce, the correction came back up for two trading sessions pushing gold to the $1721 level at the time of writing, with investors fleeing to safe havens again amid pessimistic results for global economies, the most prominent of them being the sharp downturn of the US economy. These figures were natural in light of the strict global economies closure imposed by the rapid spread of the deadly Coronavirus, which is still reaping more infections and deaths around the world. The major global economies had the lion's share of those numbers. After announcing the slowdown in the economy and keeping the US interest rate unchanged. In a statement released after the end of the latest policy meeting, the Federal Reserve raised concerns about a slowdown in inflation, which is likely to fall further below the 2% target in the coming months. This signal confirms that the US central bank is ready to keep interest rates very low as long as it takes to raise inflation again to its target.

Some Fed watchers believe that policymakers may eventually announce additional support for the economy. Ryan Sweet, economist at Moody's Analytics, said the Fed might start buying enough short-term Treasury bonds to keep interest rates on Treasury bonds for a year or two at zero. This will indicate that the US central bank plans to keep the key interest rate near zero for a long time as well.

Under Powell's policy, the Fed faces a very dangerous moment for an economy that looked strong just a few months ago. Since the virus hit at full strength last month, the largest economy in the world, which forced large-scale commercial closings that are likely to push the US unemployment rate to 20%. With layoffs escalating, retail sales declining, as well as manufacturing, construction, home sales and consumer confidence.

During two emergency meetings in March, the Federal Reserve cut interest rates to a range between zero and 0.25%. They also announced nine new lending programs to inject liquidity into the financial markets and provide support to large and medium-sized companies as well as cities and states. The Fed said in its statement that it would also continue to buy treasury and mortgage bonds to help keep interest rates low and ensure companies can easily lend to each other. They did not specify any amounts or timing for buying the bonds.

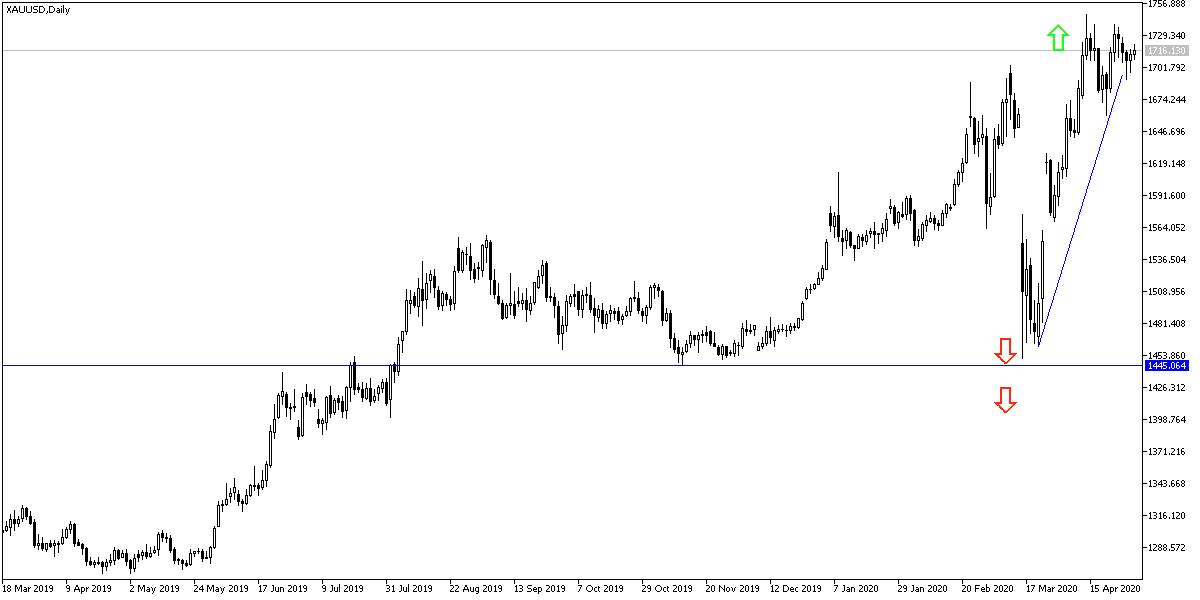

According to gold technical analysis: The continuing global concern about the consequences of the Coronavirus will continue to support gains of the yellow metal as an ideal safe haven in times of uncertainty. Accordingly, I still prefer to buy gold from every bearish level, and the closest support levels for gold are currently 1705, 1690 and 1675, respectively. Bull control will remain strong as long as the price remains stable above the $1700 resistance. The nearest gold resistance levels are now 1725, 1740 and 1775, respectively. Gold will continue to sustain gains until the reaction from the reopening of the global economy is seen.

Gold price will react today with the announcement of the monetary policy from the European Central Bank. Before that, there will be a package of important European economic data, the most prominent of which are the gross domestic product, inflation and unemployment from the Eurozone. The US session have the Unemployed Claims, PPI and Chicago PMI.