We did not witness a strong move in gold prices during the Wednesday trading, as the price of the yellow metal moved between the $1642 level and the $1656 level, and settled around the $1648 level in the beginning of Thursday’s trading. Gold price futures contracted back from their highest levels since 2012, which was recorded earlier this week. The pressure on the gold price increased after the announcement of minutes of the Fed last meetings that took place on March 3 and March 15, and showed that the worst-case scenario for the Federal Reserve would be that the economic recovery will not continue until next year.

Investors are still watching the news on developments related to the COVID-19 epidemic and its impact on the global economy. In general, gold is still more than 2% higher during the week, and on Tuesday it crossed the $1700 ounce barrier, trading at the highest level during the day since late 2012 in what analysts described as short-term pressure. Then gold returned and lost its strength to end the day down.

Back to the Corona epidemic, which has the most impact on global financial markets. In China, the mandatory closure of Wuhan was lifted, and the door opened for a return to a kind of normalcy in the place where the new coronavirus was first discovered. The city recorded the largest number of deaths due to the virus in China, with 80% of deaths occurring in the country.

In Europe, Spain remained ahead of Italy in the number of cases, although Italy still had the largest number of deaths in the world. The World Health Organization said it was "very concerned" about the spread of the virus in Europe, which now accounts for about half of all confirmed cases worldwide, and urged governments to continue containment measures.

In contrast, the United States suffered its worst one-day losses from the virus on Tuesday, when nearly 2,000 people died. 402,293 cases have been confirmed in the United States, with at least 13007 deaths, while another 22,717 people have recovered. New York State remains the epicenter of the disease. State Governor Andrew Como said that the state had suffered the largest increase in deaths in one day in the last 24 hours when 779 people died, compared to 731 in the previous period. To date, the state has suffered 6,268 deaths from the virus, far more than 2775 deaths recorded in the September 11, 2001 attacks.

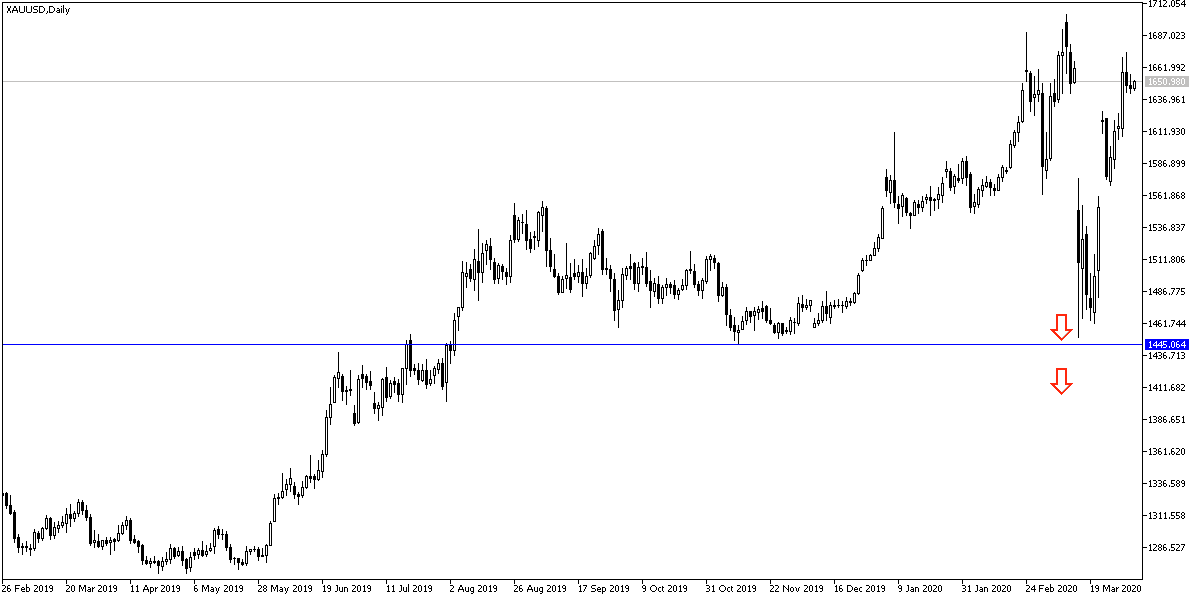

According to the technical analysis of gold: the price of gold is moving in a neutral position at present, with a lean upwards, especially if the price returns to the 1655, 1670 and 1700, levels respectively. A breach of the bullish channel may occur if the price falls to the support level at $1620. And yet I still prefer to buy gold from every lower level. Gold prices will react to the release of the UK data and Canadian job numbers. Then the US unemployed claims, producer price index and Michigan consumer confidence data.