For the fourth consecutive day, gold prices continue in a downward correction range with the support of investors' risk appetite and the walk away from safe havens. During yesterday's trading, gold price fell to the $1691 level an ounce before returning to stability around the $1707 level of in the beginning of trading today, the first important trading session this week, with the announcement of US economy growth reading in light of the Corona epidemic. This is in addition to the announcement of the Federal Reserve's monetary policy and statements of Governor Jerome Powell. Gold losses stopped after data revealed that US consumer confidence suffered a record low in April. The data results showed that Americans' confidence in the economy experienced a greater decline than expected as the coronavirus destroyed the sentiment. The consumer confidence index fell this month to a reading of 86.9 points from an average of 118.8 in March, slightly worse than economists had expected. The reading was the lowest since 2014. According to economists, the report weakens optimism that the global economy will recover quickly after it actually closed for weeks due to COVID-19 containment measures in place in most parts of the world.

As for the US stock indices performance during Tuesday's trading, we noticed a difference in performance, as while the Dow Jones Industrial Average rose by 0.6%, the Nasdaq Composite Index declined by 0.5%. The latest gains were supported by Europe and the United States intent to start easing business closures imposed by the Corona epidemic.

Any surprise from the Fed's monetary policy statement or hinting from Jerome Powell to head towards negative interest rates will affect investor sentiment and support gold gains.

U.S. President Donald Trump sees all parts of the country either in good shape or improving based on reports that the infection rate has decreased significantly at many hotspots, including New York. Some states, such as Texas, Alaska, Georgia, Oklahoma, Tennessee and South Carolina, are taking their first steps toward reopening. At a routine press conference at the White House on Monday, the president said cases of COVID-19 in the New York area, New Orleans, Detroit, Boston, and Houston were declining.

According to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University, the epidemic has so far infected 1 million Americans and killed more than 56,253 others in the country.

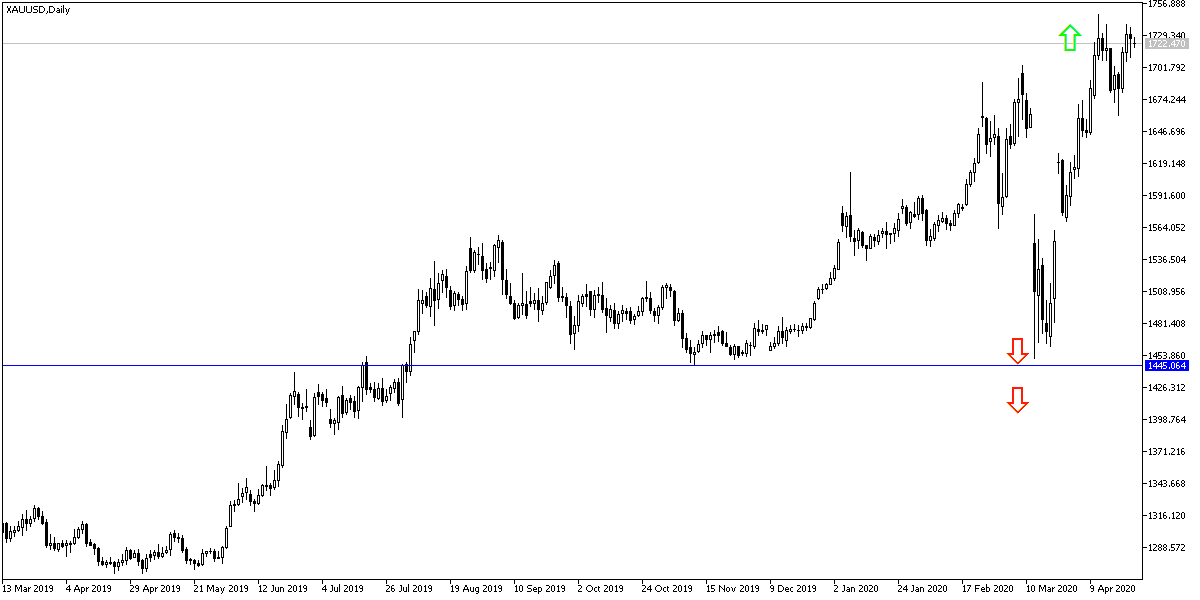

According to gold technical analysis: Stability around and above the $1700 resistance will remain supportive for the bullish trend for a longer period. Yellow metal investors are waiting for any downward correction to return to buying again, and the closest levels of support for gold are currently 1688 and 1660, respectively.

Gold will react to the release of the US economic data today, then the central bank's monetary policy decisions and the statements of its Governor Jerome Powell.