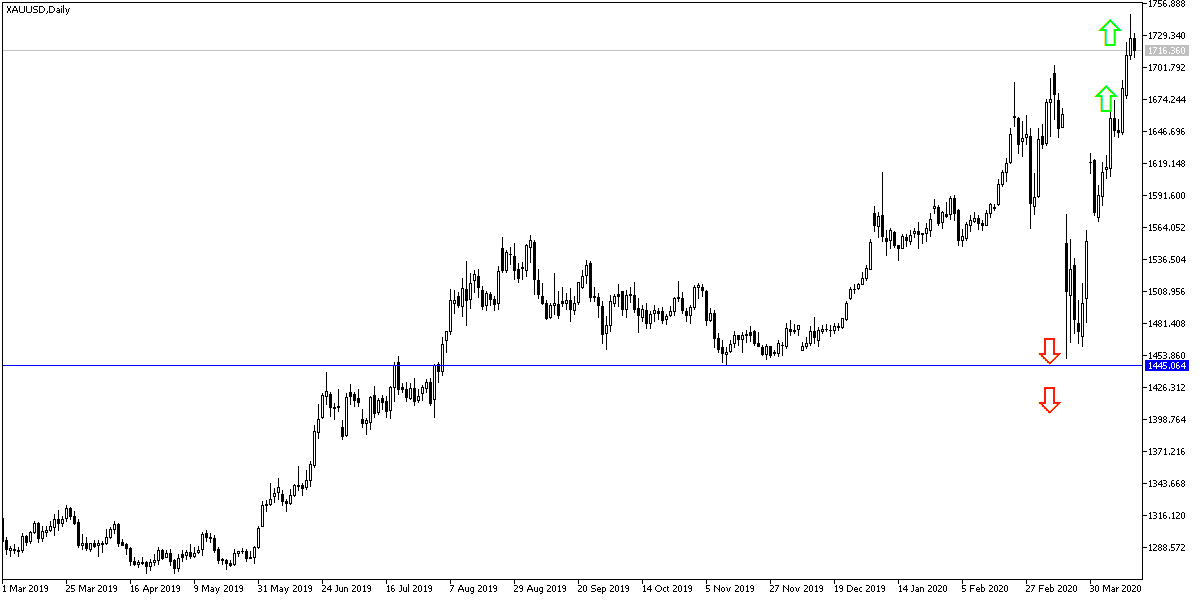

The return of strong interest by investors in gold, as previously expected, as an ideal safe haven for them in times of uncertainty, contributed to pushing gold prices to a new record and historical level at $1747, the highest for more than seven and a half years. Gold prices stabilized around the $1725 an ounce in the beginning of today’s trading, before the announcement of a package of important US economic data, and the announcement from the Central Bank of Canada of its monetary policy. With the United States of America topping the list of countries most affected in terms of coronavirus infections and deaths, U.S President Donald Trump has grown mad and started to accuse, internally and externally, around who is responsible for the rapid spread of the epidemic in the U.S.

In this regard, US President Donald Trump said yesterday that he was directing his administration to cut US funding to the World Health Organization, accusing the World Health Organization of mismanagement and coverage towards the spread of coronavirus, and promised to review the matter. "A lot of deaths were caused by their mistakes," Trump said in a daily briefing to the White House on the epidemic, adding that his administration would continue to work with the World Health Organization.

Trump, who threatened to freeze US funding to the United Nations earlier this month, said the United States is providing $400 to $500 million annually to the organization.

Because of the Coronavirus and its shock, the bleak outlook for the future of the global economy continues. The policy of the economic closures in the largest global economies is still continuing. Yesterday the International Monetary Fund warned that the global economy was poised for a severe recession which would be the worst since the Great Depression of the 1930s, as the Coronavirus, or Covid-19, caused the deaths of thousands of people, and the containment measures adopted to slow the outbreak hamper economic activity.

The IMF believes that all developed economies are expected to record sharp declines in gross domestic product this year. The advanced economies as a whole are expected to contract 6.1 percent this year and expand 4.5 percent next year.

According to gold technical analysis: The upside path still dominates the performance of gold prices, especially with stability above the $1600 resistance. The yellow metal has the opportunity to test the next psychological resistance level at $1,800, if it stabilizes above the $1747 resistance, which was recorded yesterday. Further abandonment of the dollar and the continuation of the Corona crisis may support the move towards that level soon, but taking into account not to rush, as gold is at strong overbought levels and any optimism for the markets will bring in profit-taking sales, and then levels at 1690, 1660 and 1610, respectively, may be new bearish targets.

Gold prices will react today to the announcement of the U.S retail sales and industrial production data, in addition to the Bank of Canada's announcement of its monetary policy.