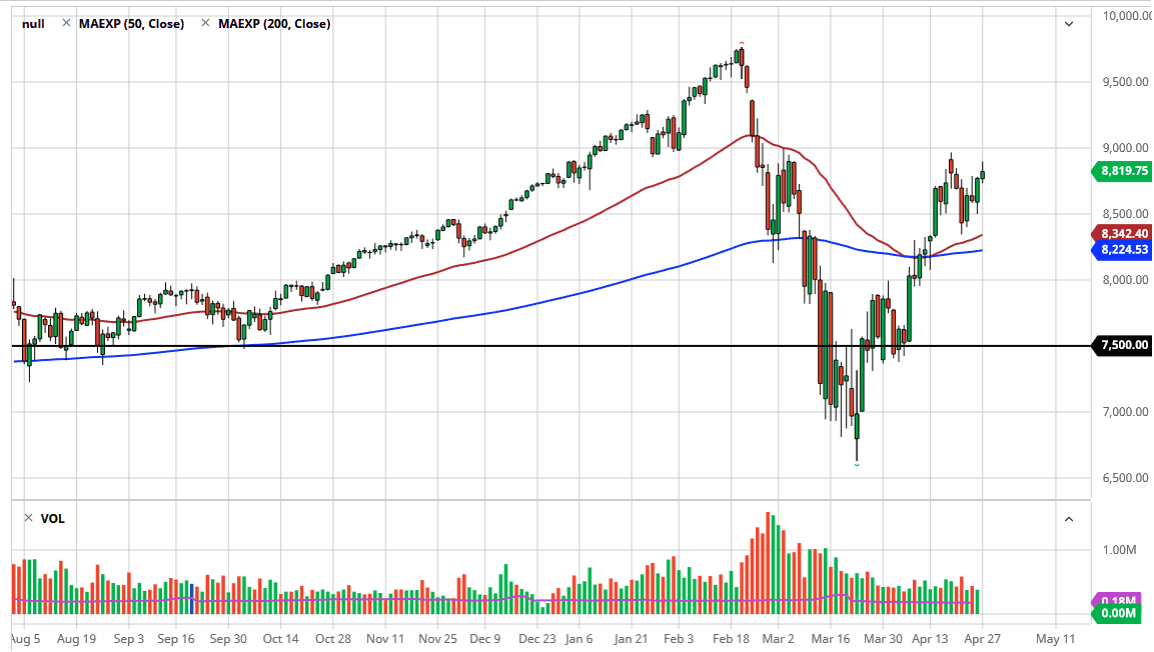

The NASDAQ 100 initially tried to rally during the trading session on Monday, and did in fact to a point, but has pulled back to show signs of exhaustion towards the end of the day. The question now is whether or not tech stocks can rekindle their magic? At this point, the 9000 level above continues offer significant resistance, as we have seen more than a few times in the past. As long as the market stays below there, one would have to think that it is only a matter of time before we rollover. Furthermore, we are in the midst of earnings season which of course is going to be an absolute disaster.

If we break down below the bottom of the candlestick for the training session on Monday, it is highly likely that the market goes back down towards the 8500 level, an area that has been supported previously. The 50 day EMA is racing towards that level as well and sloping higher. Because of this, I would anticipate that it is only a matter of time before the buyers will get involved in that area. However, if we break down below there it is likely that the market goes looking towards the 200 day EMA.

If we did somehow break above the 9000 handle, then the market could continue its massive run higher. At this point, the market could then go towards the absolute highs. All things being equal, it is likely that the market would need a bit of a “push” to get above, but at this point I think it is obvious that the rally is getting a bit “long in the tooth”, so it is likely that we could turn around and rollover. All things being equal, it does look as if we are trying to run out of momentum, so that something that should be paid attention to. I anticipate that we will pull back, so at this point it is very possible that the market will show a certain amount of negativity. I do not necessarily believe that the market is going to absolutely fall apart, but clearly, we have gotten ahead of ourselves. I would say that at this point the risk is more to the downside than it is the upside. Expect volatility, because quite frankly this is a market that will continue to suffer negative headlines and of course global economy shutting down.