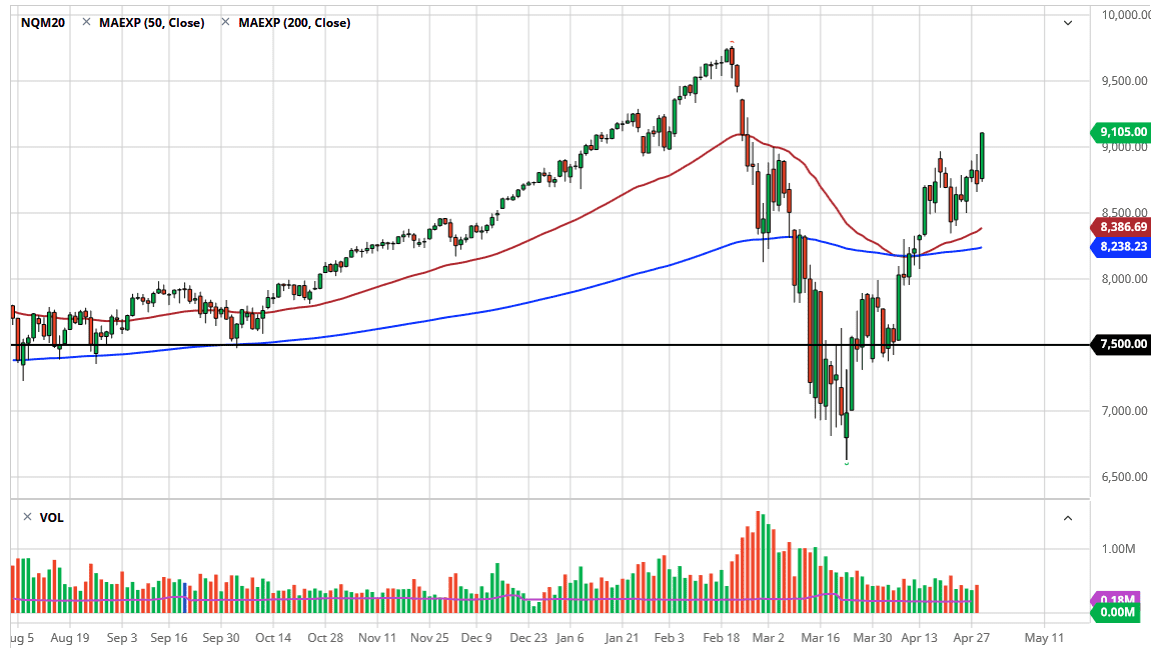

The NASDAQ 100 has cleared the 9000 level during the trading session on Wednesday, so it now looks as if we are going to reach towards the highs again. Quite frankly, the market even closed at the absolute top of the range, showing extreme amounts of bullish pressure. At this point, the market is likely to continue to see bullish pressure due to the fact that the Federal Reserve is more than willing to come in and bail everybody out. With that in mind, it is more of what we have seen over the last decade, stock markets ignoring reality as far as economics are concerned. I do believe that this market is probably going to go looking towards the 9500 level which features a gap.

Unfortunately, this has been a very massive move to the upside and the fact that we have broken above the 9000 handle it does suggest that we have much further to go. Quite frankly, it does not make any sense but at the end of the day the only thing Wall Street seems to care about is that the Federal Reserve is going to come in and provide plenty of liquidity. This of course is the catch of trading in the post Great Financial Crisis environment, the economy has taken a backseat.

With that being the case, there is really nothing to stop this market from going higher, but we may get the occasional pullback. Then pullback is now obviously well supported quite a bit, and therefore you cannot fight it. I personally have been on the sidelines for quite some time and have missed most of this, taking most of my trades in the currency markets. That being said, the one thing I know you cannot do is sell this market so at this point you need to be very cautious and recognize the fact that the NASDAQ 100 is going to continue to outperform any other indices around the world, while most of them are falling apart. The highs are calling, and it is highly likely that we could get there in the next few weeks. As amazing as that sounds with an unemployment rate somewhere around 20% in the United States, it is what it is, and you simply cannot fight the algorithms at this point. Shorting is all but impossible at this juncture as any attempt to short this market has led to serious pain.