The NASDAQ 100 has gone back and forth during the trading session and volatile trading on Thursday yet again as we are at the peak. That being said, it looks as if the 8500 level continues to offer quite a bit of support underneath, and I think as long as we stay above there, we have the possibility of some type of consolidation. The NASDAQ 100 of course is heavily influenced by a handful of companies though, including Microsoft, Apple, Amazon, and Facebook. In other words, all of the favored companies by most of the “buy-and-hold” investors.

That being said, the NASDAQ 100 doesn’t necessarily move the same way that a lot of retail traders think it will. It’s essentially the same thing as biting ETF of those four stocks. Yes, there are other stocks involved in the index, but the top four make up roughly 35% of the entire index. If those companies do well, the NASDAQ 100 by its very nature will. In a sense, it’s very much like the US Dollar, and the EUR/USD as the Euro is a major input.

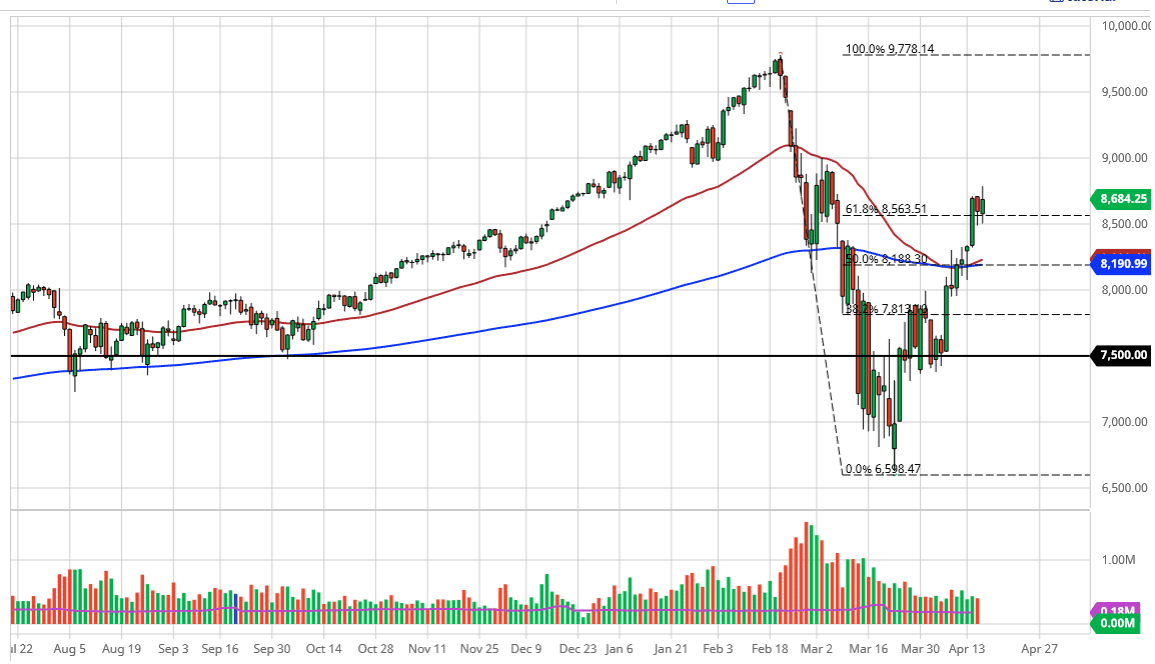

That being said, we are at an area that was a very noisy previously and was the beginning of the massive breakdown. I think at this point we are looking at a market that is getting a bit stretched, and one has to wonder whether or not the day of reckoning is coming. Clearly, we have fallen off of a cliff only to turn around and bounced almost straight up in the air. Volatility should continue to be a major component to this index, and I think that there is a lot of noise between here and the 9000 handle. If we break above the 9000 handle, then there’s nothing to stop this market from going to the all-time highs. On the other hand, if we break down below the candlestick from the Tuesday session, then it’s likely that we could break down and go much lower, perhaps reaching towards the 8000 handle. As it is Friday, don’t be surprised at all if we see a little bit of weakness heading into the weekend as people will be concerned about carrying too much risk. I believe that we are going to grind sideways until we make some type of impulsive candlestick that should have quite a bit of follow-through in one direction or the other. Quite frankly, we are at an inflection point.