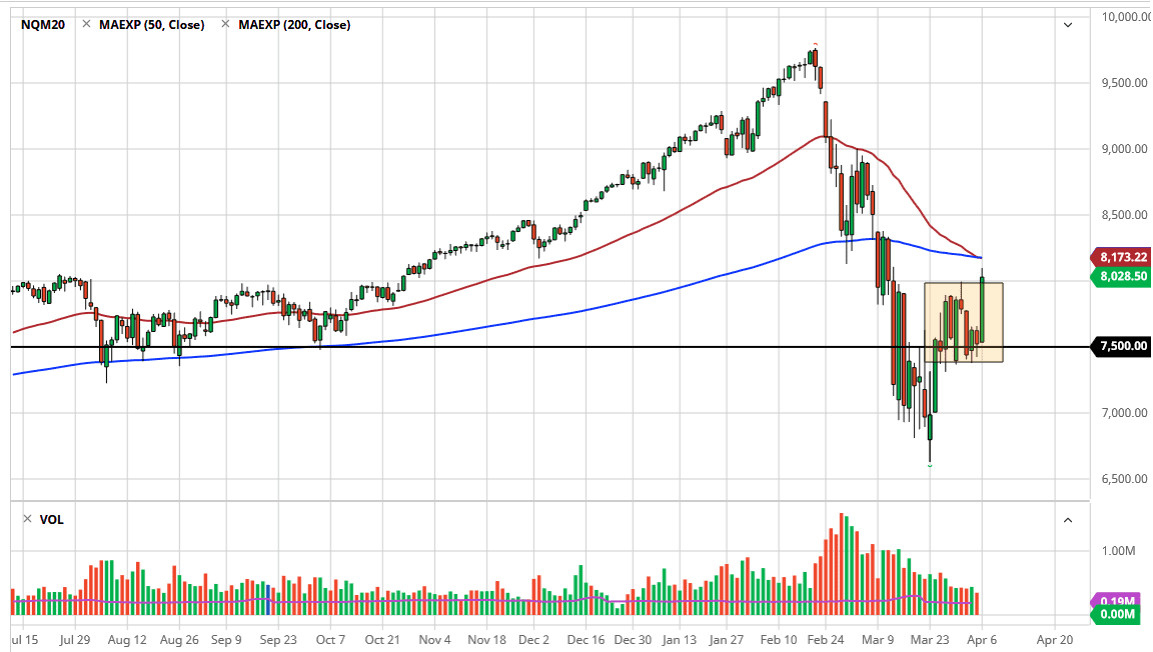

The NASDAQ 100 has rallied significantly during the trading session on Monday, breaking above the 8000 handle. That level was massive resistance, so the fact that we closed above there is a very bullish sign. With that in mind, and the fact that the S&P 500 also rallied above resistance, it suggests that we are in fact going to go looking towards the 200 day EMA above, perhaps even the 50 day EMA which is getting ready to cross below it to form a “death cross.”

The market did get some good news on a health standpoint, as it looks like the market is celebrating the fact that the coronavirus infection rates and deaths are starting to slow down in places like New York City and Italy. Keep in mind that New York City is home of both of these indices that we cover here at FX Empire, so there is a certain amount of “home gaming” when headlines cover New York City. This isn’t to say that it can’t drive the market higher, it’s just that these indices tend to be a little bit more sensitive to New York than anything else.

If we do pull back from here, as long as we stay above the 7450 level, we have the possibility of keeping the uptrend intact over the last couple of weeks. At this point I believe that the market still is probably going to try to fill the gap above that sits just below the 8500 level, so signs of exhaustion there could end up being a nice selling opportunity. All that being said, the NASDAQ 100 is highly correlated to technology and therefore it’s very likely that the markets are trying to figure out where to go next but are banking on the fact that a lot of these online companies that are being used so heavily are involved in this index. In other words, the NASDAQ 100 will probably lead the rest of the market, thereby pulling the S&P 500 higher, perhaps even the Dow Jones Industrial Average. All things going on right now point to a lot of volatility, so keep that in mind. The fact that we closed towards the top of the candlestick is a very bullish sign to keep that in mind as well. One thing is for sure, the next couple of weeks are going to see a lot of the sudden moves based upon the latest coronavirus headline.