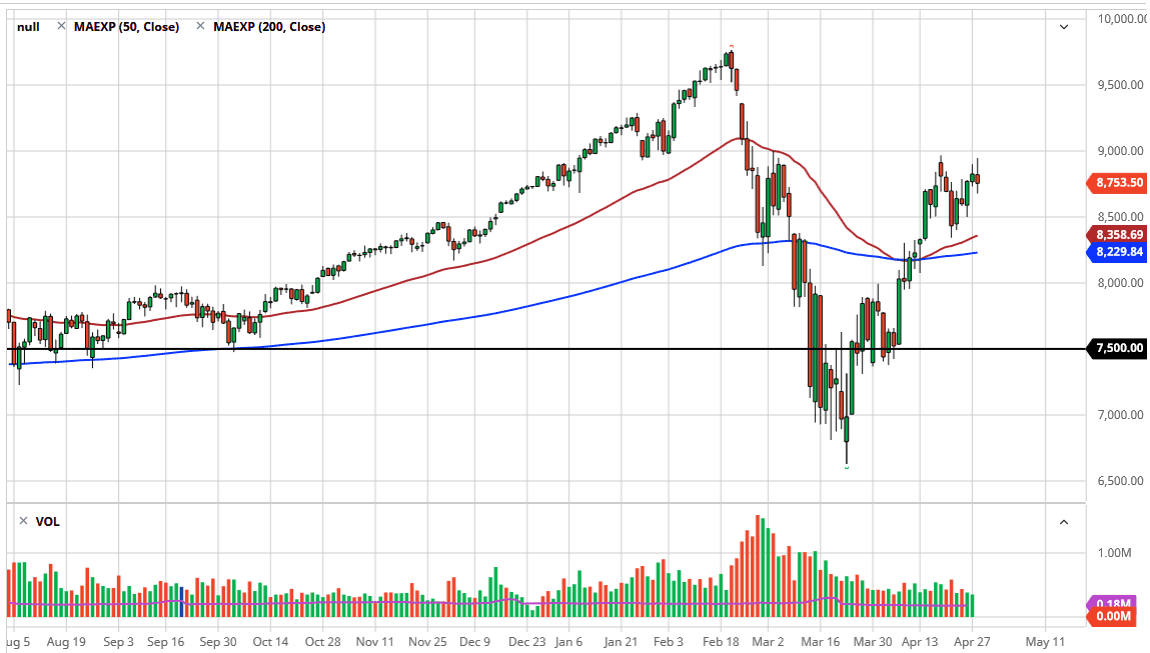

The NASDAQ 100 has gone back and forth during the trading session on Tuesday, forming a very ugly candlestick as it looks like we are going to continue to struggle to get above the 9000 handle. That is an area that has caused resistance previously, and it is likely that the market will continue to fade from that region. That being said, it does not mean we cannot break above there, but the reality is that we are struggling in that area.

Breaking above the 9000 level would open up the market to reach towards the gap above which is just below the 9500 level, and therefore it would be a move that would make a certain amount of sense from a technical analysis standpoint. Having said that, the market is likely to continue struggling with 9000 in the meantime, especially as the Federal Reserve is likely to rock the markets as they speak at the end of the Wednesday session. Heading into that statement, it is going to be incredibly quiet would be my guess, as traders are trying to figure out whether or not the Federal Reserve is going to continue to loosen monetary policy. At this point in time, it is likely that we will continue to see a lot of noise, but if the Federal Reserve disappoints, we could see a significant break down as 9000 has shown itself to be so important. The 8500 level underneath could be a significant amount of support, and therefore it makes a nice target.

If we break down below that level, then it is likely that the market goes down to the 8250 level, perhaps reaching towards the 8000 handle. By the end of the day on Wednesday, we should see a little bit more in the way of clarity, and thereby could make a significant move after that clarity comes. Ultimately, I believe that the market is going to see a lot of noise and then eventually take off in a bigger move. Looking at this chart, I do think at the very least we have more consolidation ahead of us if not some type of breakdown. If we do break out to the upside, it is likely that the downtrend is over with both stock markets in the United States. Having said that, we will have completely divorced from reality, something that the market has been doing for a while.