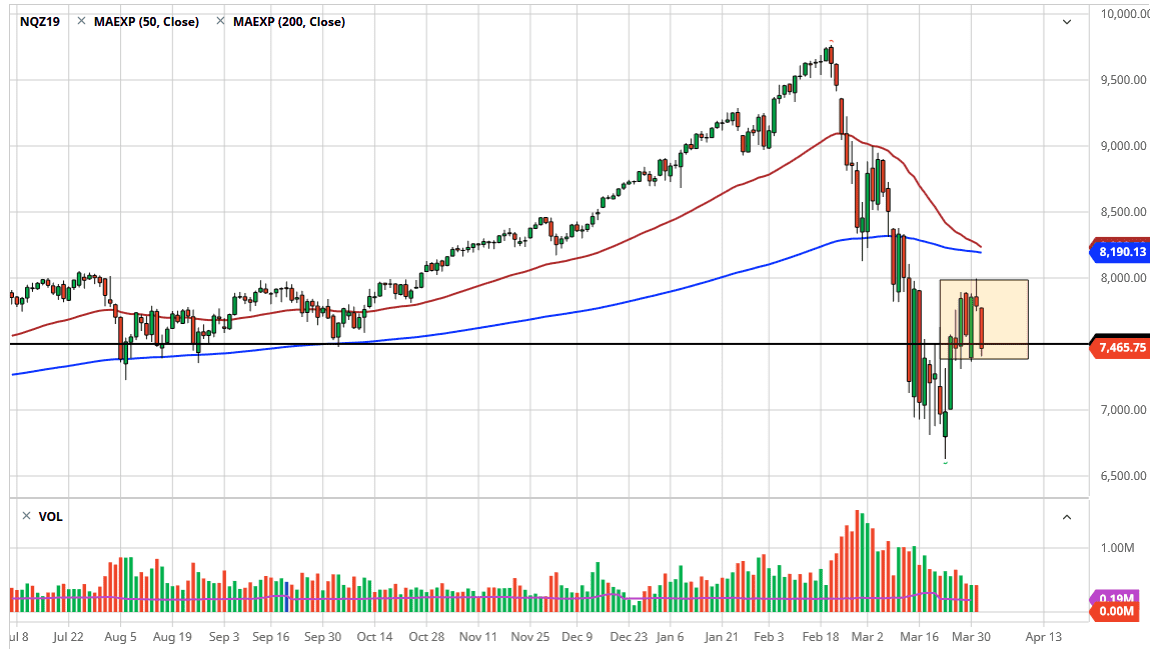

The NASDAQ 100 fell hard during the trading session on Wednesday, breaking the bottom of the shooting star that had formed on Tuesday to fill out the same consolidation area that we have been in. At this point, I believe it’s only a matter of time before we break down a little further, but the question now is more or less “Can we hold the bottom?”

Ultimately, this is a market that is trying to figure out whether or not the market is going to find a longer-term bottom, or if we are about to get another leg down. One thing is for sure: there is plenty of negativity out there to punish this market. We are getting ready to get the jobs number on Friday and most certainly traders will be paying close attention to that figure. If it is better than anticipated we will probably see the NASDAQ 100 turn around and shoot straight to the upside. However, if it is softer than expected that could have this thing falling apart rather rapidly.

The candlestick of course is very negative and the fact that we have wiped out most of the range from the bullish Monday candlestick tells me that there is nobody that has any significant confidence in this market longer term. All things being equal I believe that the market desperately needs some type of retest of the bottom for people to be convinced. There are a lot of moving pictures and headlines out there that will cause major issues. To the upside, if the market was to break above the 8000 handle it would be a very bullish sign but after the action on Wednesday it seems very unlikely to happen before the jobs number. In fact I believe that the time between now and that announcement could be very difficult to trade because we will simply be looking at the latest headline and a lot of speculation as to what could be coming next.

I think volatility is here to stay, at least for the foreseeable future and that is going to be a very big problem. Because of this you need to keep your position size rather small so that you don’t get wiped out on some type of huge volatile move based upon fear or greed. In these environments we need to be very careful in order to keep our trading accounts alive.