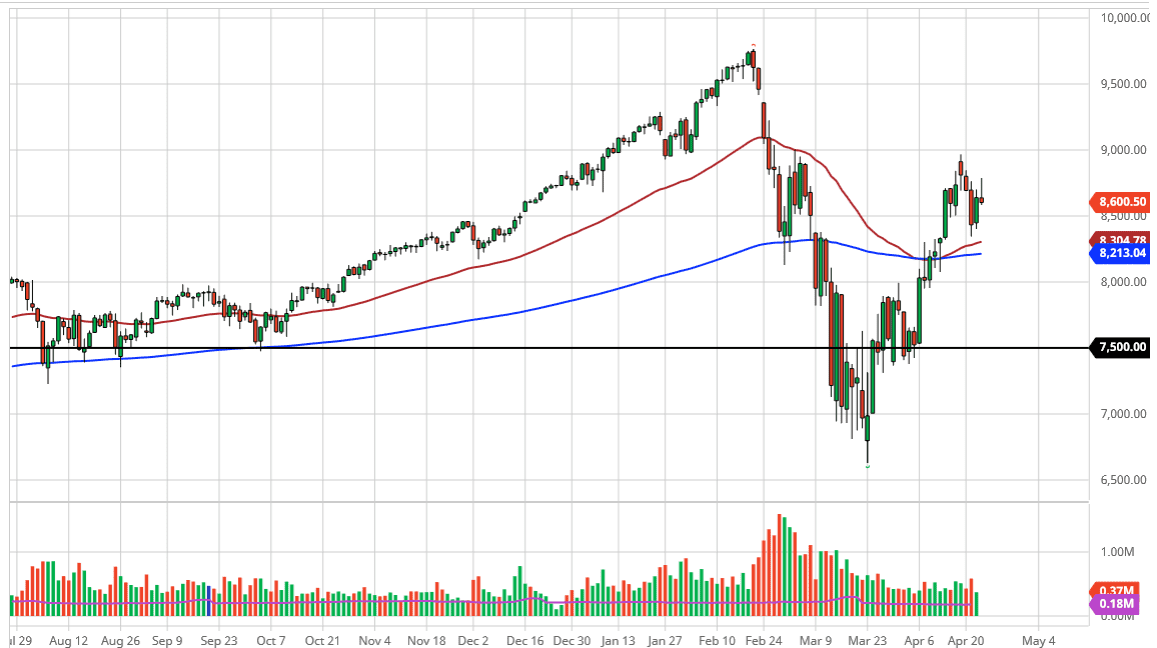

The NASDAQ 100 initially tried to rally during the trading session on Thursday but gave back quite a bit of the gains in order to form a massive shooting star. The shooting star of course is an extremely negative sign and it shows a certain amount of exhaustion. At this point, if we break down below the bottom of the candlestick it is highly likely that we go looking towards the 8500 level next for support, and then perhaps even the 8400 level which is where we had seen a bit of support underneath. On the other hand, if we break above the top of the candlestick it is likely that we will continue to go looking towards the 9000 handle. The 9000 handle of course is a large, round, psychologically significant figure, and it is also an area that has been a bit of a double top. It certainly looks as if we have run out of momentum.

And that is a major problem when it comes to the NASDAQ 100, because it is almost by definition a momentum based index. Because of this, this is an awfully bad sign and likely will bring in a bit of short covering. Remember, the NASDAQ 100 is compiled of Facebook, Google, Alphabet, and Netflix covering 33% of movement. In other words, this is the leading indicator when it comes to the darlings of Wall Street. If they start running out of steam, the NASDAQ 100 almost has to fall by its very definition.

The 50 day EMA is sitting at the 8300 level, just as the 200 day EMA is sitting at the 8200 level. All things being equal, as we go into the weekend it is difficult to imagine that we will suddenly explode to the upside, and it should be noted that there were rumblings about some of the most promising drugs to combat the coronavirus failing. If that is going to be the case, obviously that is going to be an extremely negative sign as well. At this point, I do not believe that this pair has the momentum to go higher for a significant move, at least not without pulling back quite a bit. The 8000 level underneath should attract a lot of attention if we do in fact have what I believe is a necessary drop due to the erratic behavior of the market and the lack of any earnings.