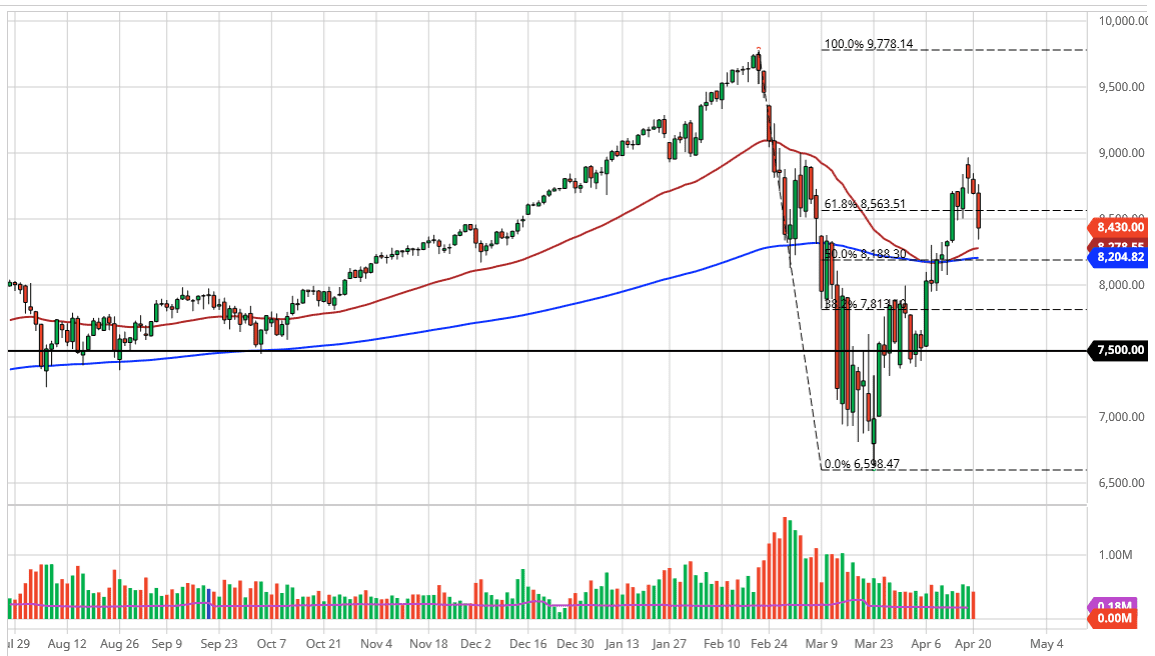

The NASDAQ 100 is starting to adjust to a new reality, at least that is what it is starting to look like right now. The 8500 level has been broken to the downside and of course the 50 day EMA underneath should offer plenty of support. The 50 day EMA also sits just above the 200 day EMA at the 8200 level. All things being equal, looking at this chart it almost looks as if we have just formed a bit of a “double top” in the sense that the 9000 level has seen selling pressure a couple of times.

To the downside, the market was to break down below the 200 day EMA, then it would bring in fresh selling to send this market closer to the 8000 handle. A break down below there then opens up the door to the 7800 level, followed by the 7500 level given enough time. I believe that is the path going forward, as the market certainly looks to be a little bit exhausted at this point. Quite frankly, we are in the middle of earnings season which is probably going to be a very sour affair.

The size of the candle is rather negative, although we did bounce just a bit towards the end of the day. All things being equal though, the NASDAQ 100 is essentially an ETF when it comes to how it trades, as it is essentially Facebook, Google, Amazon, and Netflix. The four companies make up over 33% of how this index is calculated. In other words, if the main four stocks do well, by its very definition this index will typically do fairly well.

That being said, I think there are a lot of concerns out there and although this may be a bit mispriced, I feel that rallies will be sold into so look at those as potential selling opportunities and less something changes quite drastically. Until then, I look at rallies as opportunities to take advantage of shorting this market as it has no business being this high. Stock markets have bounced far too hard in the economic condition, and it is likely that we will continue to see the sellers come out any time this market rallies as the economic conditions continue to deteriorate worldwide. I believe that we have more than likely seeing the intermediate to be laid out during the trading session on Friday.