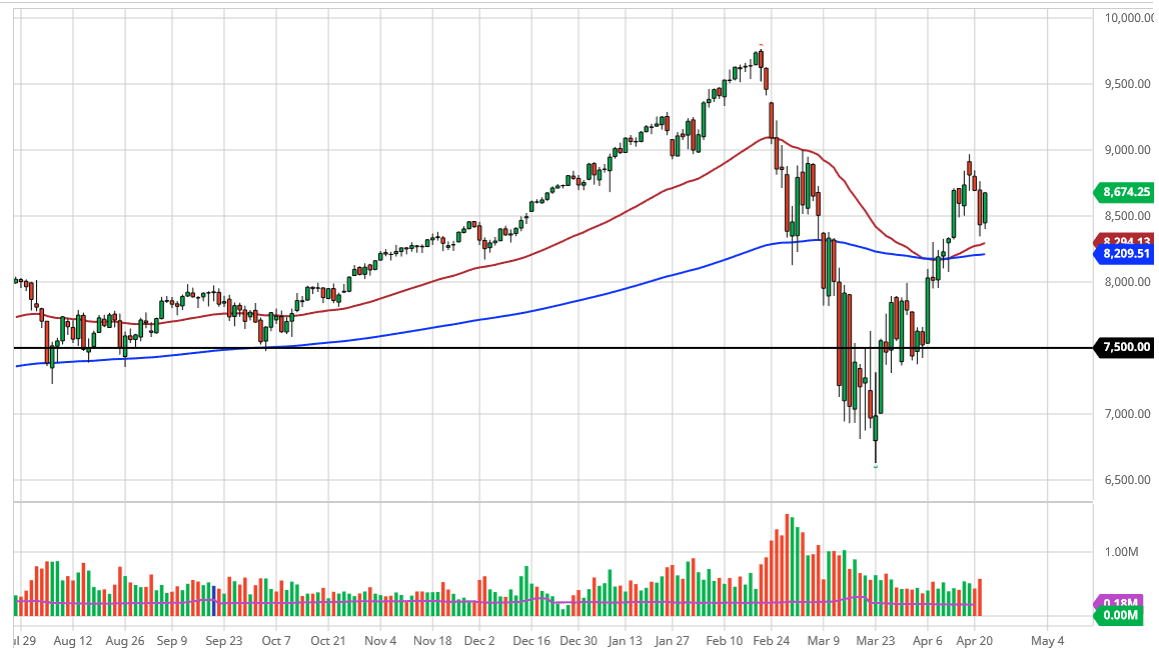

The NASDAQ 100 is likely to see a bit of trouble just above, although we may have a little bit of upward pressure in the short term. I believe that the 9000 level will continue to offer major resistance, as the area have seen sellers jump in a couple of times now. There has not been that much that has changed in the economy or the markets in general that would turn this market right back around other than perhaps a bit of short covering, or in this case perhaps a bit of Netflix earnings that have people feeling better.

I do recognize that the 50 day EMA is sitting underneath and technicians will be paying quite a bit of attention to that. However, that is a minor factor when compared to the fact that there has been a major gap underneath. This is the first time in economy has simply been shut down completely, so it is difficult to imagine that everybody knows exactly what is going to happen next. Corporate profit and loss is going to be absolutely abysmal for the next six months or so, so one would have to think eventually it will weigh upon stock markets in general.

All that being said, the NASDAQ 100 is likely to outperform the S&P 500, but that of course is something that we see quite often. After all, roughly 1/3 of the gains or losses in this index are due to Netflix, Amazon, Apple, and Google, which of course is now listed as Alphabet. If these four stocks are rallying, this index should as well. However, one would have to wonder how much longer this can go on due to the fact that both Facebook in Google are facing a major loss of advertising revenue.

To the downside, I believe that the 8000 level will probably be a major target, followed by the 7500 level. At this point it is highly likely that those areas could attract a certain amount of value hunting and having said that I do not necessarily think that this market is going to fall apart immediately. I think it has probably going to be more of a grind lower but right now I do not have much of the selloff set up to get involved with. I am interested in shorting a little closer to the 9000 handle, because I can get out of a losing position rather quickly if it is proven to be wrong.