The NASDAQ 100 has gone back and forth during the trading session on Thursday, showing signs of exhaustion, as we have gone back and forth quite a bit during the trading session. The market has stagnated a bit, although it has formed a green candlestick. That suggests that the market is trying to go higher but there is a gap just above that should cause some resistance, and I think that a pullback could be coming. This would make quite a bit of sense going into the weekend, as the trading community might be a bit hesitant to hold risk into the weekend. Furthermore, part of the appetite for the NASDAQ 100 would certainly be due to the Federal Reserve looking to add $2 trillion worth of liquidity into the markets as they are buying junk bonds, and ETF versions of that.

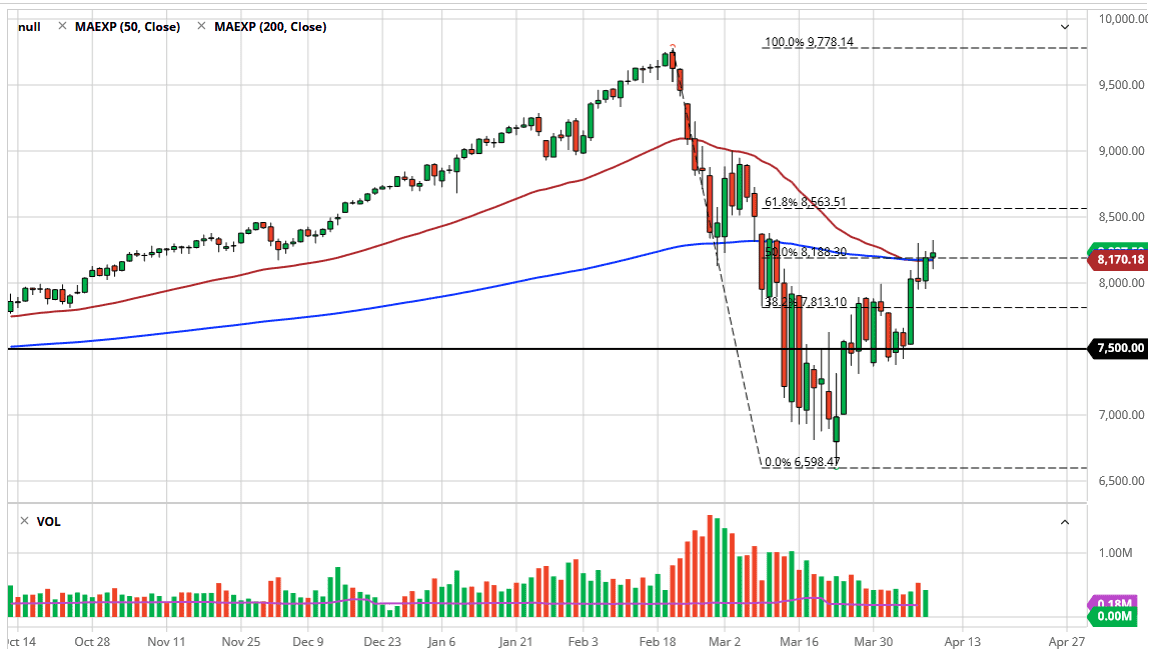

The 50 day EMA is sitting right about where price is, and so is the 200 day EMA. The fact that the two moving averages are essentially going sideways tells you that the market is going to run into some trouble here, and the question is whether or not we can shoot to the upside. If we can, the 8500 level would be the next target. If we break above there, then the market will more than likely go looking towards the 9000 handle after that.

On the other hand, if we were to break back down below the 8000 handle, the market could run down to the 7500 level, an area that has been supported in the past. If we were to break down below there, then the bottom falls out. It’s difficult to imagine a scenario where we don’t get some type of big move, and I believe we are setting up to do that rather quickly. All things being equal though, it does look like we are running into a lot of trouble and therefore it’s not overly surprising that we could chop back and forth for a while, and with it being Friday I’m not going to be surprised if we end up basically where were at right now. That being said though, we have a couple of levels to pay attention to in order to place our next significant move. The 50% Fibonacci retracement level is right here as well, so let’s not forget that either.