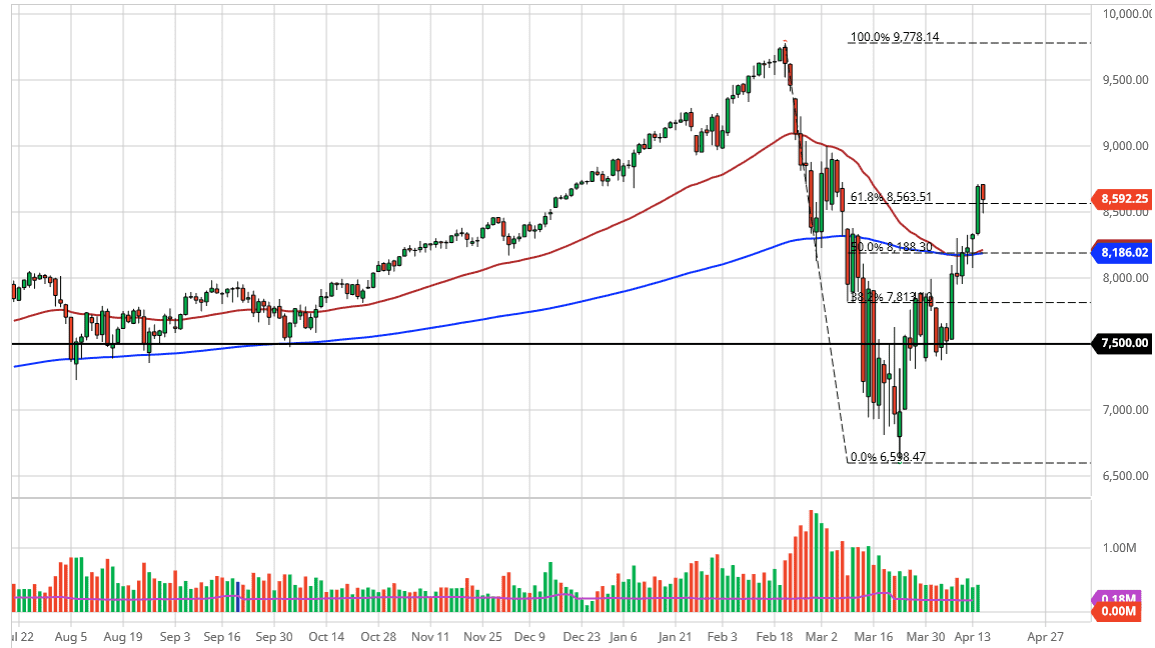

The NASDAQ 100 fell during a large portion of the trading session on Wednesday but do pull back a bit to recapture some of the losses. There was a huge surge in the NASDAQ 100 during the previous session on Tuesday, and it is much more bullish than the S&P 500 is. However, the market is currently trading right around a major congestion zone on the way down, and of course we are a bit parabolic. As the technical analyst, I am looking at the candlestick for the day and wondering whether or not it is going to end up being a “hanging man”, or something to that effect. If it does end up being that, meaning that we break down below the bottom of the range for the trading session on Wednesday, that would be a rather negative sign.

Underneath at the 8180 level there is significant support to be found in the form of the 50 and the 200 day EMAs. There is also a bit of congestion in that area as far as price action is concerned, typically a sign that there is a lot of order flow. At this point, the NASDAQ 100 has gotten way ahead of itself from what I can see, but you should also keep in mind that the NASDAQ 100 is not an equal weighted index. In other words, there are a handful of companies that make up a majority of the momentum. These are the big companies, places where people for all of their money at. This is why the NASDAQ 100 has tended to outperform most of the time.

If we do break to the upside, I believe there is a hard ceiling closer to the 9000 level. Breaking above there would more than likely open up even more bullish pressure in a market that has been parabolic to begin with. I find it extraordinarily difficult to think that we are going to see that, even though we are in the middle of an earnings season that people are giving a large pass to give the fact that we are going through a global lockdown. Having said that, there’s no earnings out there to be had for most companies, and that should eventually show up in the stock market yet again. The S&P 500 looked very negative enclosed much closer to the lows of the day than the NASDAQ 100 did, so there is probably still a bit of pressure on this market.