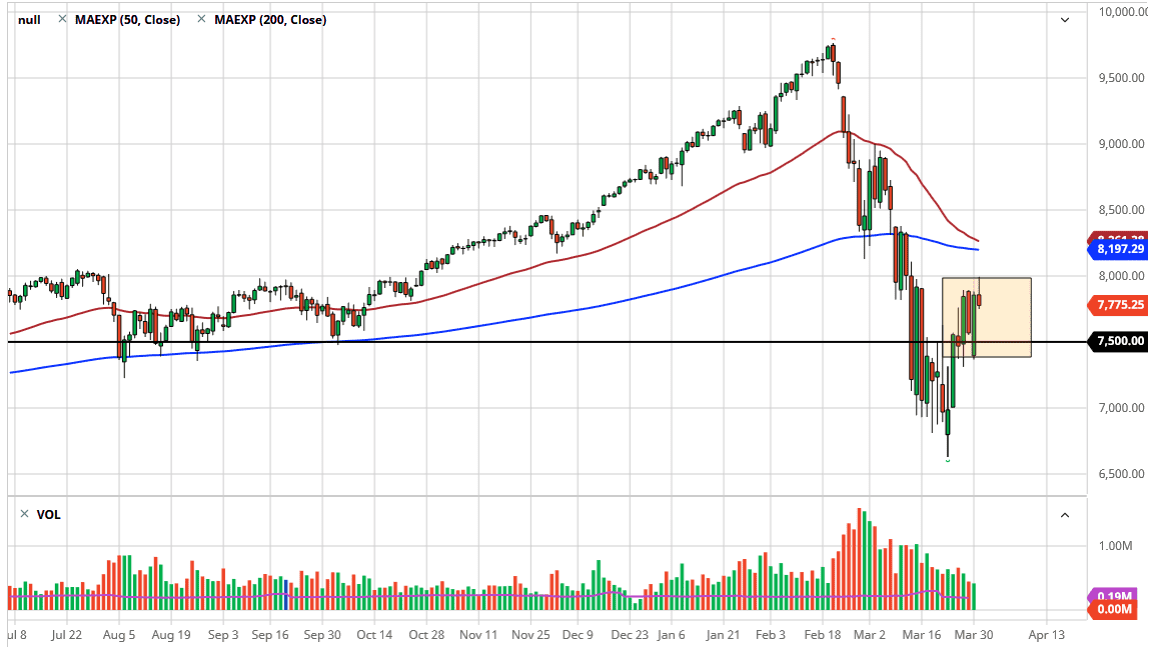

The NASDAQ 100 initially tried to rally during the trading session on Tuesday but gave back the gains as it approached the 8000 level. The large, round, psychologically significant figure was too much for the market to get past, and therefore it looks as if we are going to drop right back into the consolidation area. This isn’t much of a surprise considering that there are so many crosswinds out there that will continue to cause issues, and of course the fact that we are getting close to the jobs number on Friday.

With that in mind, it looks like we could drop as low as 7400 and essentially make no decision one way or the other. The market has been chopping back and forth and that’s probably to be expected after bouncing the way it has. With this, I believe that the market is probably going to continue to go back and forth but if we were to break above the highs from the trading session on Tuesday, meaning that we cleared above the 8000 handle, then we could very well melt up a bit, perhaps trying to reach towards the gap at the 8500 level.

That being said, I don’t trust significant moves between now and Friday, so I am much more apt to trade short-term back-and-forth type of positions, as the markets trying to discern where to go next. There are so many headwinds out there that I find it very difficult to imagine a scenario where we simply take off in one direction or the other without something major happening. There is a lot of fear out there, and although the NASDAQ 100 has done relatively well due to the fact that the technology companies have been used so drastically to “work from home” and continue the “social distancing” that has been so pervasive around the world. Ultimately, I do think that it’s only a matter of time before some of these companies really start to take off, but they will be the leader of the markets, not necessarily moving in concert with the S&P 500. However, if it does continue to rally you could start to see a bit of a “catch up trade” over in the S&P 500 and the Dow Jones Industrial Average. That being said, I believe the next couple of days are going to be noisy and more or less sideways than anything else.