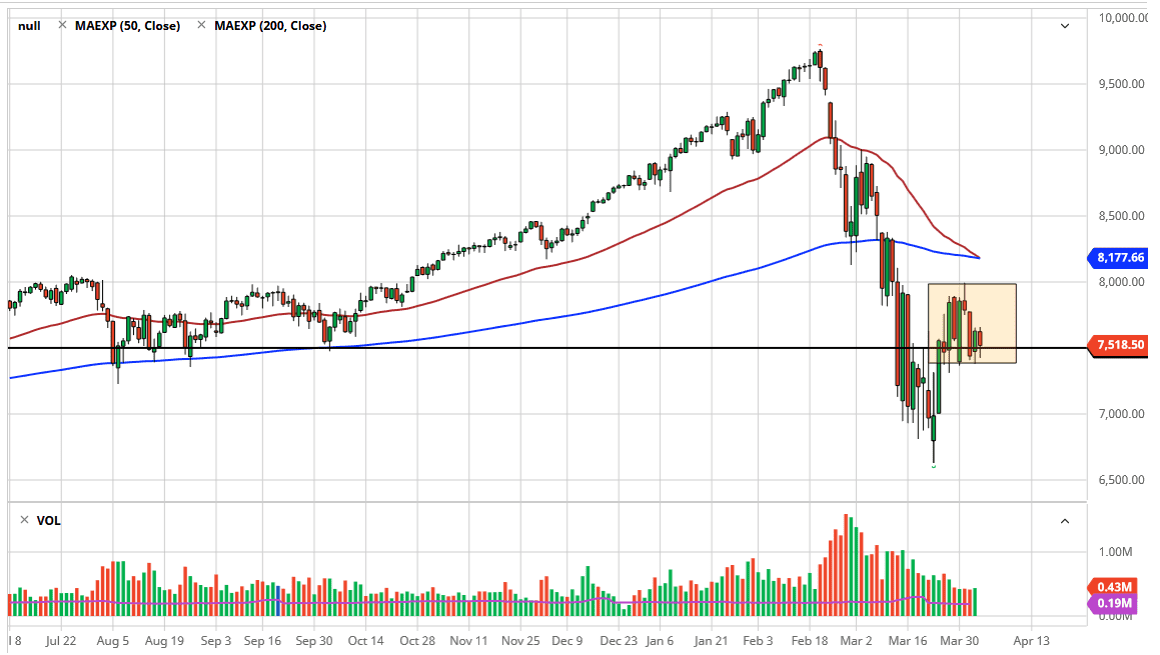

The NASDAQ 100 fell during the trading session on Friday as we continue to see a lot of volatility in stock indices around the world. Furthermore, the “death cross” is about to happen, so that will probably cause a few headlines out there. I don’t necessarily believe in that indicator, mainly because by the time it happens typically the move was 80% of the way to where it was going in my experience.

The 7500 level looks to be very important, but I think 7450 and 7400 is probably even more important. If we can break down below that level, then we will go looking towards the 7000 handle underneath. To the upside, the 8000 level above will be massive resistance. In the short term, we could very well go back and forth in this little box that I have drawn on the chart but it clearly looks as if the market is negative overall, and you can make an argument that NASDAQ 100 companies will be a little bit more insulated for the coronavirus effect considering that a lot of these companies work in the “work from home” space. Ultimately, I do like the idea of playing outside of this box, meaning that once we break out of it, we can start trading in one direction or the other. It is worth noting to the upside we could go as high as 8500 on a break above the 8000 level because there is a gap up there that has not been filled.

All that being said, we are in a downtrend, so I favor the downside in general. If you are a range bound trader, you can trade inside this box that I have drawn in probably do quite well. It’s worth noting that the last couple of highs from the last couple of days are much lower than the ones from earlier in the week. That tells me that we are more than likely “leaning to the downside” at this point. In other words, all we need is some type of negative headline to get things racing to the bottom again. I believe that there are more volatile days ahead, so therefore we need to pay attention to a lot of issues around the world and in the news for the week it will be crucial. Going into the weekend though, I am flat of most positions and this market is certainly one of them that I am not involved in right now.