The NASDAQ 100 has dropped during the Monday session as we continue to see a lot of weakness out there in general. That being said, the stock market indices have done fairly well but you should also keep in mind that the NASDAQ 100 has 33%, roughly, of its value derived from Facebook, Apple, Amazon, and Google. In other words, all of the Wall Street darlings. In other words, if those four stocks do a bit better during the session, by definition the index itself typically goes higher. In other words, there is a lot to look at underneath the hood.

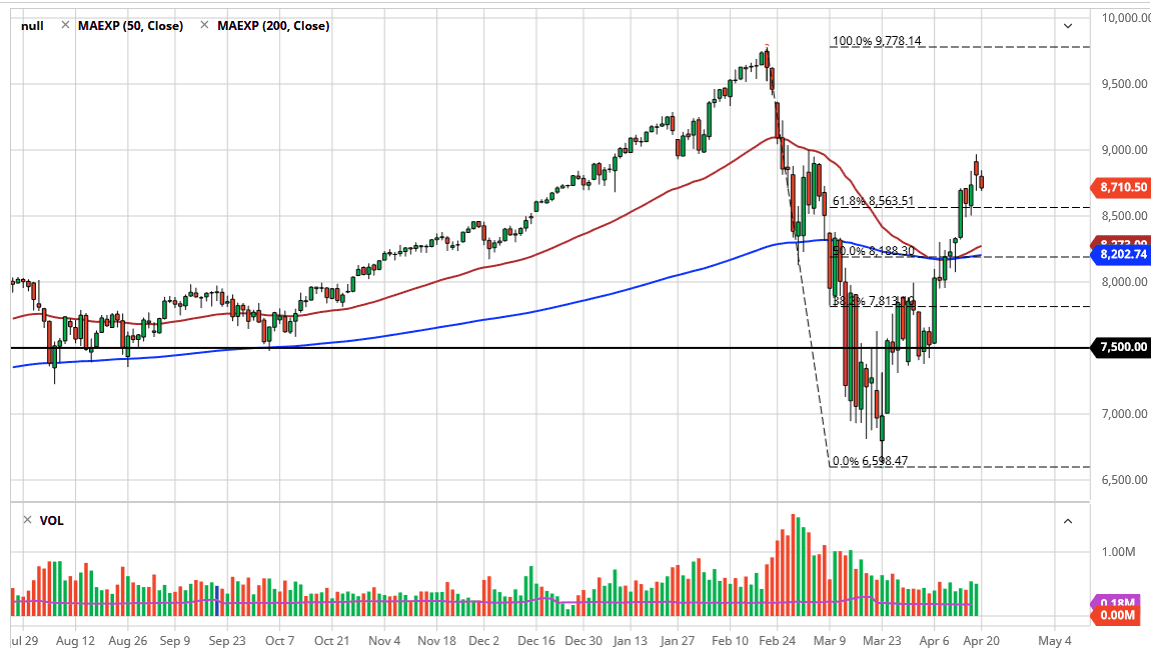

Looking at the technical analysis, we clearly have seen a lot of bullish pressure. The 9000 area has shown itself to be rather resistive, so I think if we were to turn around a break above that level it’s very likely that the market goes looking towards the all-time highs again. I find that very difficult to think it’s going to happen anytime soon, at least not without some type of interaction by the Federal Reserve to prop up the markets. That being said, the Federal Reserve has already crossed several lines during this crisis, so that’s not entirely out of the question.

The 50 day EMA touched the 200 day EMA several days ago but is starting to turn higher. I suspect the market will probably try to test that, given enough time. If we do fall below the 8500 level then it’s likely the 50 day EMA gets tested, and then finally the 8200 level and the 8000 handle. I favor the downside over the upside, because we have seen a “V-shaped rally” when there is no sign of actual growth out there. At this point, it simply feels as if all you need is some type of catalyst to knock this thing right back down.

There are a lot of different ways to play the NASDAQ 100, as there are futures contracts, ETF markets, CFD markets, and of course options. The most important thing you will do when it comes to trade in this index going forward is to be able to control your position size. You should not be trading large positions, despite the fact that it looks like you could get rich overnight. That leads to ruin and I would suggest that’s probably the most important thing that you can glean from any analysis.