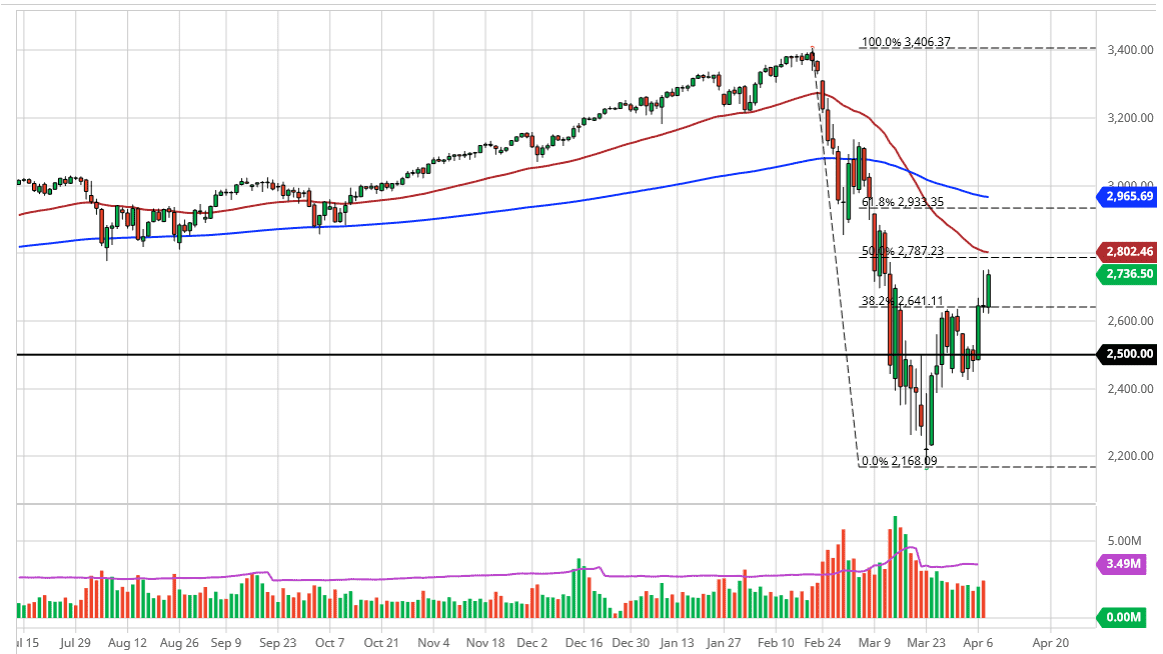

The S&P 500 rallied significantly during the trading session on Wednesday, testing the top of the shooting star from the previous session. The top of the shooting star should be rather resistive, and it certainly looks as if the 2800 level will be as well. After all, the 50 day EMA is sitting right around the 2800 level and that will of course offer a significant amount of downward pressure. If we were to break above that, it would obviously bring in more buying and we could go looking towards the gap above which is sitting near the 2950 handle.

In that same general vicinity, the 61.8% Fibonacci retracement level would also be in that area, so it’s very likely that we could see selling pressure again. Beyond that, the 200 day EMA is sitting in the same general vicinity as well. Ultimately, that is a long-term trend defining indicator the people are quite often going to pay a lot of attention to, so I think at that point the rally would probably stop. Quite frankly, when you get a massive breakdown like we’ve had, a 50% correction is not a huge stretch of the imagination. I think at this point it’s only a matter of time before the sellers jump back in, because quite frankly this is a market that got battered by the idea of a global economy that was slowing down. Quite frankly, even though the coronavirus numbers are getting better, we are a long way away from recovery. Because of this, I think it is only a matter of time before we sell off again.

It should also be noted that volume has been rather light on this rally, so I think at this point you have to wonder whether or not there is any real efficacy and it. That being said, I do recognize that the market can be quite exuberant when it wants to be, so we will need to be very cautious. I think the weekly candlestick is probably going to be much more important as a rally from here could find itself turning around at the 50 day EMA. On the other hand, if the market breaks down below the last couple of candlesticks, I think the move to the 2500 level will be rather quick and brutal. Ultimately, this is a market that is getting ready to make a move, all we have to do is wait and see how it turns out.