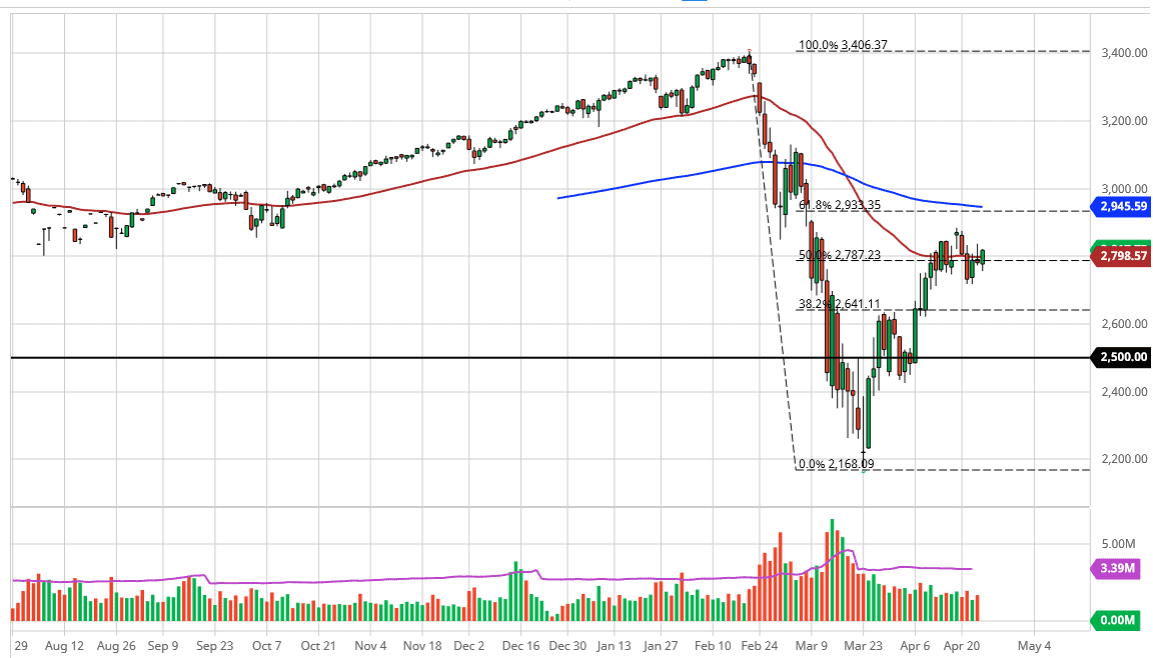

The S&P 500 initially fell during the trading session on Friday but then bounced as Europeans went home. The market continues to see a lot of volatility, but at this point it looks like we are running into a bit of resistance, although the market is closed towards the top of the range as traders took advantage of weak liquidity. At this point, I believe that the market is going to continue to see the 50 day EMA as a possible technical issue, not to mention the fact that we are right here at the 50% Fibonacci retracement level. I think we go back and forth, as the latest headline will for the market right back around. We have been trading based upon the latest headline when it comes to the coronavirus and we obviously have a lot of potential danger over the weekend. Because of this, it has difficult to know how confident traders are right now.

To the downside, I believe that the Tuesday and Wednesday session on for a nice “floor” in the market, so if we were to break down below that level, it is likely that we drop towards the 2640 handle. To the upside, if we can break out of all of the noise and clear the highs from the week, it’s likely that we go looking towards the 2950 level which is essentially where the 200 day EMA sits, the 61.8% Fibonacci retracement level is, and of course the massive gap that has yet to be filled.

With all of that in mind, I think that the market continues to see a lot of choppy and volatile trading. Quite frankly, there is no clear direction at this point as we are at a level that is going to test both the patience of buyers and sellers at the 50% Fibonacci retracement level will cause a lot of headlines. I favor the downside at this point, although I am the first to admit that the Friday close was very encouraging for bullish traders. With that being said, we have clear highs and lows to work from, so I think at that point we can place some type of confidence and a trade. Again though, it is unfortunate, but we are trading based upon the latest headline and therefore there will be a lot of erratic and dangerous trading environments ahead of us.