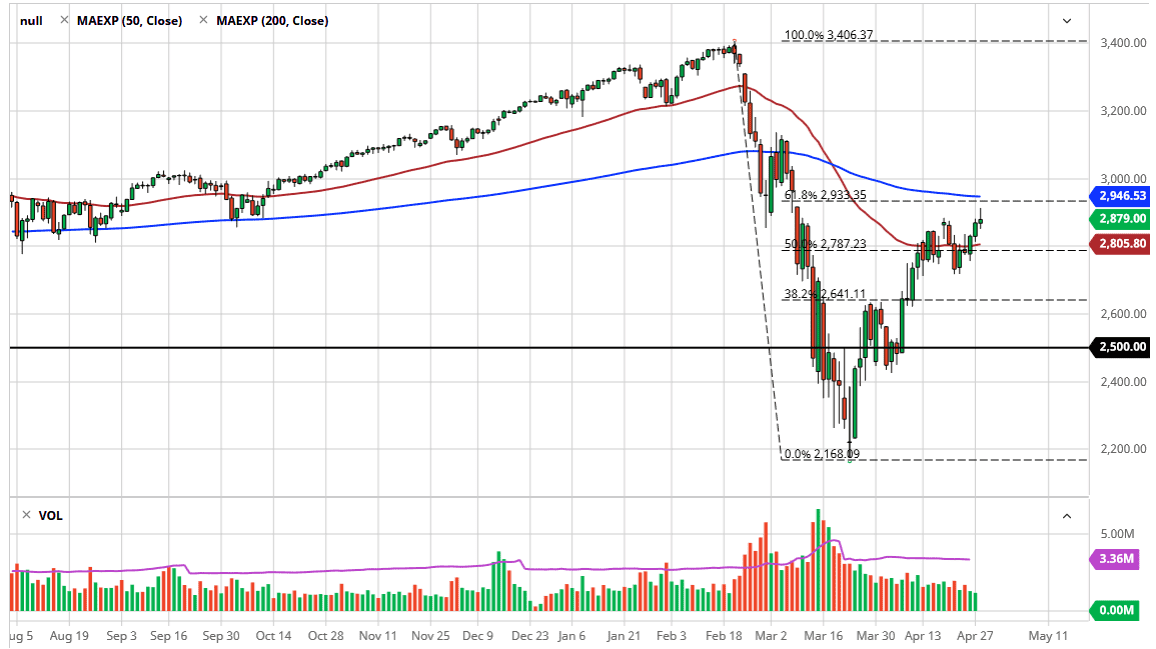

The S&P 500 has run into a brick wall on Tuesday, as we initially shot higher but found enough resistance to turn things around and form a bit of a shooting star heading into the close. Ultimately, I think that the 200 day EMA and the gap above will continue to cause major problems. That being said, it is probably only a matter of time before the market pulls back towards the 50 day EMA unless of course the Federal Reserve comes out and fails out Wall Street yet again. It is very unlikely that the Federal Reserve is going to give Wall Street enough to continue pushing the market higher in my estimation, but they certainly will not do anything to wreck the stock market either.

If we break down below the bottom of the shooting star for the trading session, then I think we go looking towards the 50 day EMA, and then the 2775 level. All things being equal, the market is getting close to the gap just above, and that gap which also features the 200 day EMA, the 2950 level, and the 61.8% Fibonacci retracement level is a tall order to get through. That being said, if anybody can push the markets higher it will be the Federal Reserve as it appears that the market has front run some type of sugar high that the Federal Reserve could give Wall Street. If that is going to be the case, then it is very likely that we could get a “sell the news” type of situation as well.

One thing is for sure, we are probably better off waiting for 24 hours in order to see some type of clarity when it comes to what the Federal Reserve does, because that is without a doubt one of the biggest movers of the market for the week. Furthermore, we will have the jobs number at the end of next week, so between the two announcements we should get some type of central bank clarity. We are trying to reinflate the asset bubble at the moment, which sooner or later will run into trouble. That being said, wait to see what happens after the announcement before putting money to work but we have clear levels to pay attention to how markets behave and react to the Federal Reserve and its statement. We are at the top of the short-term range, so it comes down to whether or not Jerome Powell can throw the market over the resistance.