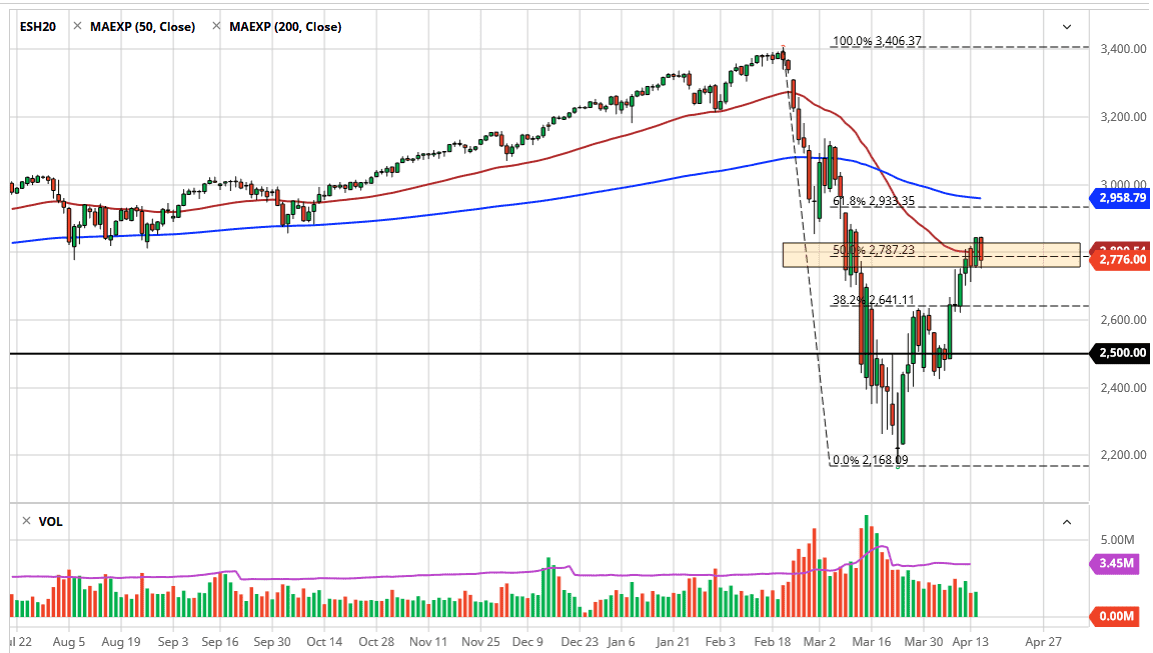

The S&P 500 has fallen a bit during the trading session on Wednesday, as we continue to hang about the crucial 50% Fibonacci retracement level. Furthermore, we have the 50 day EMA in this same neighborhood, and that of course will attract a lot of attention by technicians on Wall Street. I believe that if we break down below the low of both Tuesday and Wednesday, the market could start to rollover rather significantly, perhaps reaching down towards the 2640 level. If we break down below there, then it’s likely that the market then starts look for support at the 2500 level.

The stock market has completely disconnected with reality, as you can see from this massive bounce. Supply chain issues will continue to be a major issue for the economy, as China was sleeping for a month, and therefore we are getting ready to run into the lack of supply instead of lack of demand. In other words, this is a long-term issue that I think Wall Street hasn’t bothered to factor any of this in. I do recognize that we could go higher from here, but I think there is a significant ceiling above.

At this point, I believe that the area just below the 3000 level is about as high as this market can go, and this is predicated upon the 61.8% Fibonacci retracement level and a gap forming at the same level. Beyond that, there is also the 200 day EMA and the same neighborhood, so I think at this point there are plenty of reasons to think that the market will probably struggle to get above there. If the market does get above there, then clearly the markets have completely disconnected from the real world.

I do think that if we can break above the highs of the last couple of days it will be a strong sign that the bullishness comes back into the marketplace but when I look around, there are only a handful of “risk on” assets that I see that look relatively okay. One of them is the NASDAQ 100, but when I look at currency markets and the like, there is strong demand for safety, so I suspect there is probably more of a downward momentum in this market than anything else. The real question of the day is going to be whether or not this was simply a “bear market rally?”