The S&P 500 bounced significantly during the trading session on Wednesday as the market has started to focus on the possibility of everything being awesome again, but the reality is that the economic situation will eventually bring the market back to earth, as the economic damage done to the economy is obviously going to weigh upon earnings, and at this point it seems as if there is a massive selloff just waiting to happen. Signs of exhaustion will more than likely appear, and they should be an opportunity to start selling again. At this point, the market continues to run on hope, but earnings are going to be through the floor.

Furthermore, one has to wonder whether or not the economy will be anything remotely close to normalized, even after the governments around the world lift the lockdown. After all, there are going to be massive ramifications as to how the public acts after this time, as some of the reaction to the coronavirus has been borderline hysterical by the public. In other words, it has highly likely that there are going to be major changes when it comes to the behavior of the American consumer, which is roughly 70% of the economy. This does not mean that the market cannot rally from here, just that eventually the reality will catch up.

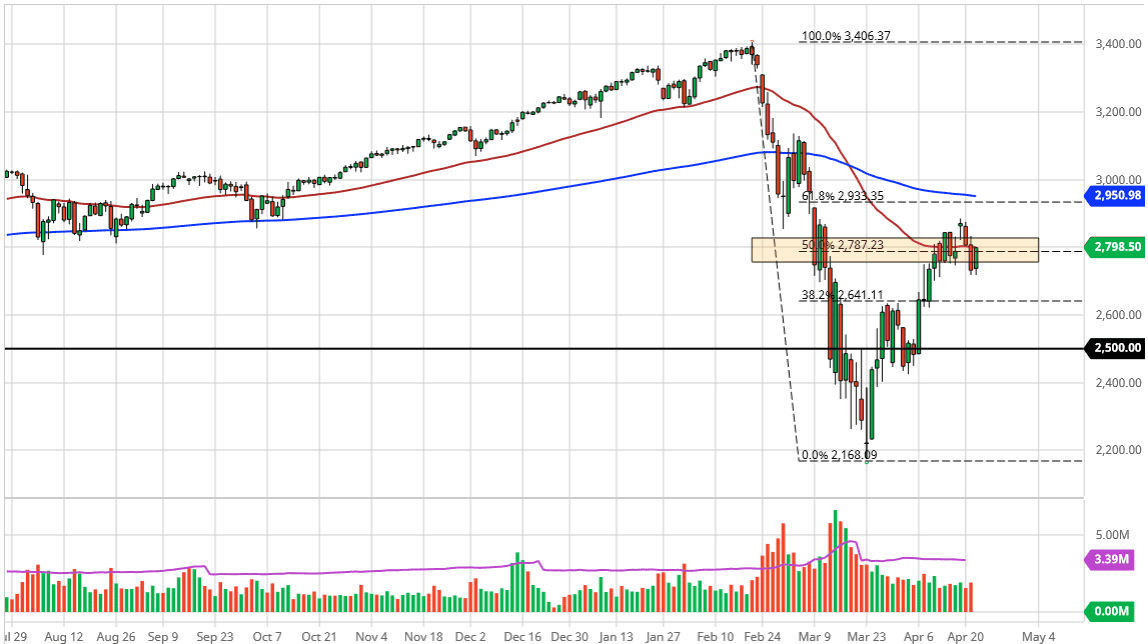

To the upside, I see the 200 day EMA offering a significant amount of resistance, especially considering that there is the 61.8% Fibonacci retracement level in that area, and a massive gap. Furthermore, the 3000 level is just above there, so I think at this point what we are going to see is massive resistance that will be difficult to overcome. In the near term, we could continue a little higher, but I think it is only a matter of time before the selling pressure from earlier in the week comes back into play. The target to the downside on a break down below the Tuesday and Wednesday candlesticks would be a move towards the 2640 handle, which was previous resistance. I believe that if you are patient enough, you should see enough exhaustion to jump on. I do not have any interest in buying this market at this point, because it has gotten a bit too expensive, as the P/E ratio for most companies are just as high as they were back in February when the whole thing broke apart.