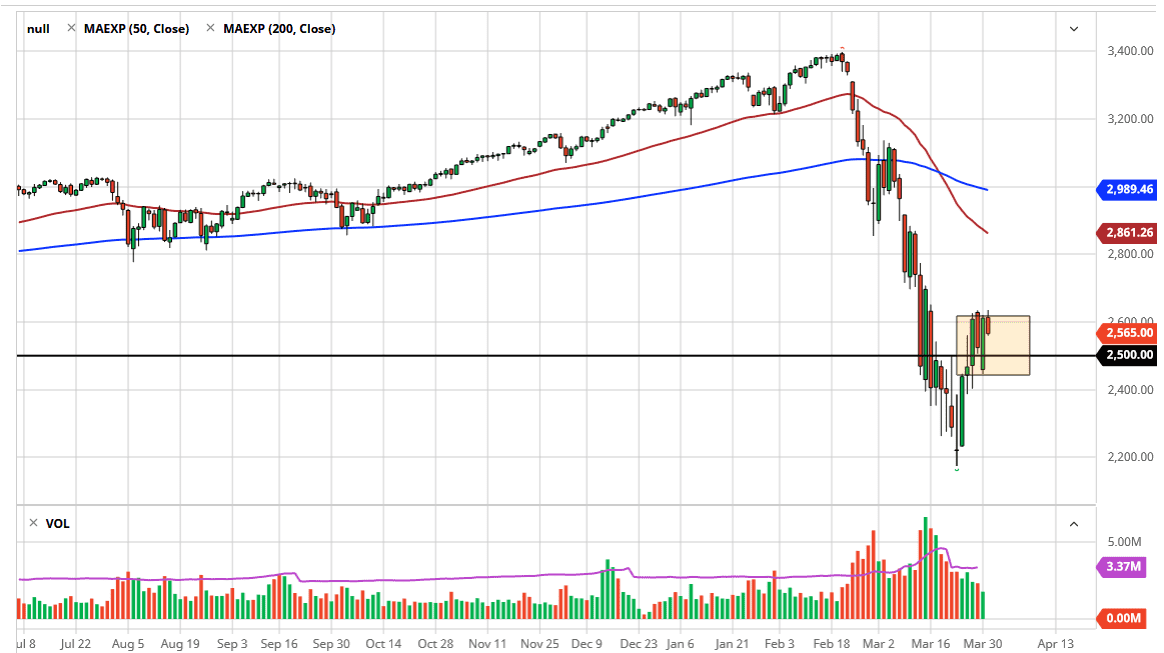

The S&P 500 initially tried to take off to the upside but gave back the gains on Tuesday as we continue to see a lot of volatility. The fact that we could not break out of the range tells me that we are probably still going to see a lot of noise, and as a result I would anticipate more of a sideways action between now and the jobs number. We know that the jobs number is going to be horrible on Friday, but the question is just how horrible?

To the downside, I see the 2450 level as being rather important support, and if we break down below there, we will start to try to chip away at the 2400 level. Having said that, if we turn around a break above the 2650 level, then the market is probably going to go looking towards the 2750 level next. I do think it’s a possibility that it happens but the closer we get to the jobs number; the less traders will be willing to throw a lot of money into the marketplace as headline risk increases.

At this point, I do believe that if we do break to the upside, we then start to look at a potential selling opportunity at the 2750 handle, and most certainly at the 50 day EMA. I don’t necessarily think that the market is going to break down drastically, but I do think that most traders are looking for some type of supportive action on another pullback to confirm what we already know. With this, I like the idea of buying on dips, but I need to see a significant break in order to get involved. Ultimately, this is a market that is probably going to suffer simply because it seems as if it is going to take quite some time for the global markets to pick back up as global trade is dropping precipitously. That being said, most of what’s going to influence this market is going to be coronavirus numbers in the United States and Western Europe. China has already gone back to work and if the West can recover relatively quickly, then it’s possible we get an extended drive higher. It seems a bit premature to expect that right now though, so I like playing the range that I have marked on the chart for the time being, albeit with small positions.