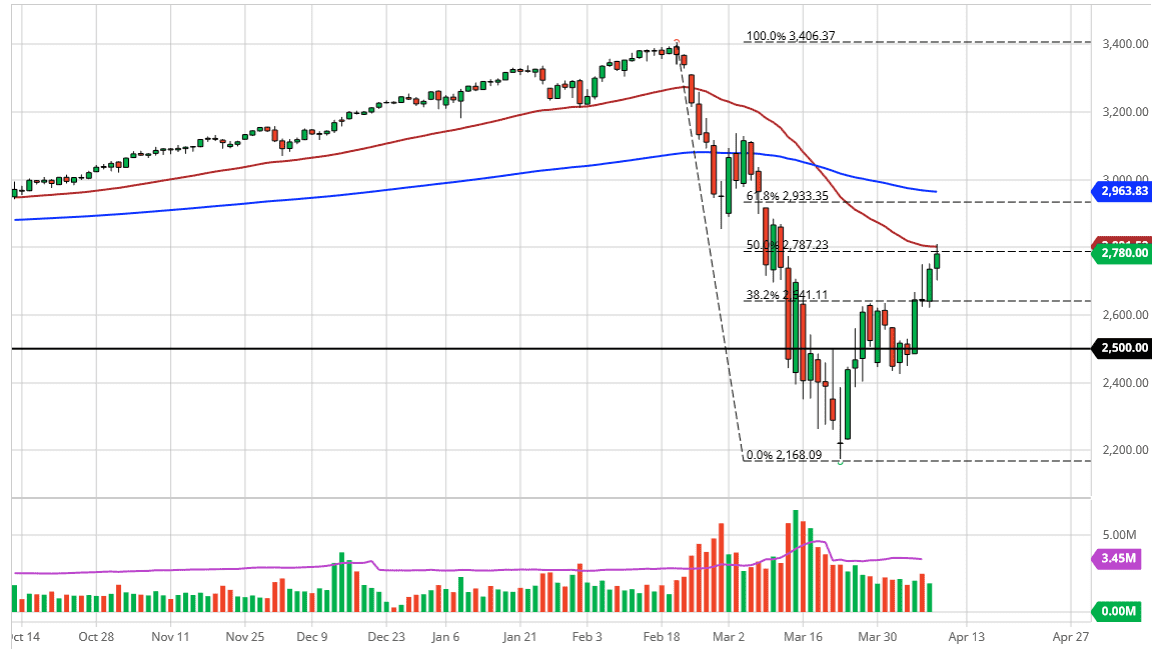

The S&P 500 initially pulled back a bit during the trading session on Thursday but then Saul enough bullish pressure to reach towards the 50 day EMA, which is right at the 2800 level. With that being the case it’s likely that we could see a little bit of stagnation heading into the weekend. However, if we close above the highs of the session on Thursday, that would be very bullish sign going into the weekend, perhaps sending the S&P 500 to go looking towards the gap near the 2970 level.

On the other hand, if the market was to break down below the lows of the trading session on the Thursday candlestick, that could send this market down to the 2650 level, possibly even the 2600 level after that. That being said, if we get some type of bad news that could send these markets reeling, especially considering that the Federal Reserve is come out with so much in the way of stimulus. $2 trillion is no joke, and that is part of why we have seen a positive reaction. However, it’s likely that the fact that the market couldn’t shoot higher than it has suggests that perhaps the markets have already trying to price and quite a bit of good news.

If we do take out to the upside, it would be very bullish but then we would have to deal with the 200 day EMA above. The 3000 level obviously has a lot of psychological significance, so I would expect sellers to come back into the market in that place as well. In general, bear markets tend to bounce like we have seen, but they also tend to roll over again. If that is the case, then we will try to form a “higher low” that could form a longer-term bottom. The market forming a massive “V pattern” would show extreme bullishness. I think that is a sentiment that is probably a bit overstated it that is what people are anticipating. At this point, I do believe that it’s only a matter of time before we have to make a bigger decision, but they do so on a Friday might be a bit difficult. We will have to look at the weekly candlestick in order to discern what to do next, but one thing that’s worth noting is that this has been a very bullish week. Having said that, now we are facing significant headwinds.