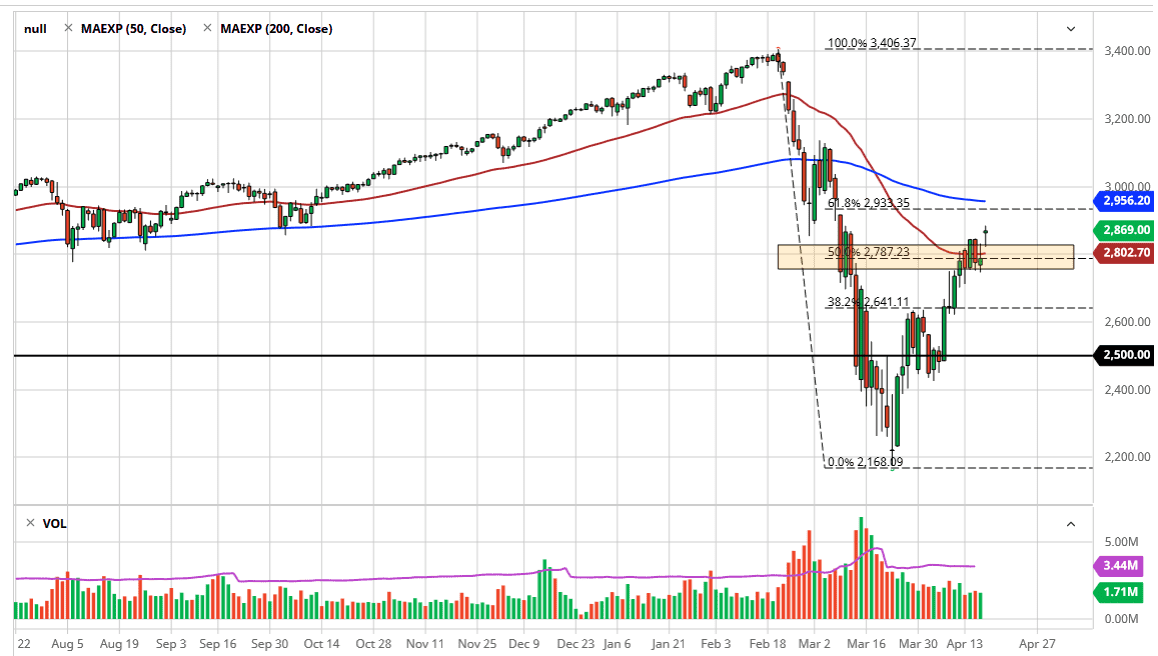

The S&P 500 is going to test a gap, regardless of which direction it moves now. After gapping higher on the open on Friday, and then pulling back to bounce before filling the gap, it does suggest that there is plenty of buying pressure. However, there is a gap above that has yet to be filled and that could of course offer quite a bit of resistance. I think at this point, the S&P 500 is purely emotional, and therefore it’s difficult to buy this market with any type of conviction, just as it is difficult to sell it with that same conviction. I believe at this point, the 50 day EMA underneath offers plenty of support that is slicing through the gap, but at the same time the 200 day EMA above offers plenty of resistance at that gap. Confused yet?

At this point, we have had a very strong rally from the bottom, and it certainly looks as if we are trying to continue to go to the upside. The question now is whether or not this is a simple matter of hedge funds and others trying to front run the Fed, as a lot of people believe that the Federal Reserve is going to step in and start buying ETF packages. This is what the Bank of Japan does, and if that’s the case there is a natural “floor” in the market. That leads to a disaster down the road, but in the short term it can levitate the market.

Simply put, if we break down below the lows of the Thursday session, I am a seller of the S&P 500 because we will go much lower, with an eye on at least the 2640 level, possibly even 2500. To the upside, I believe that the 200 day EMA, currently at the 2956.20 level, should offer resistance. If we break above that then obviously, we will test the 3000 handle, but I think breaking above there is asking a lot. Given enough time, we should have a nice shorting opportunity but right now it’s just not there. Short-term FOMO may continue to be the way this market looks, but over the weekend all it’s going to take us some type of negative news to knock this market right back down. This is the world we live in, with volatility off of the charts most of the time.