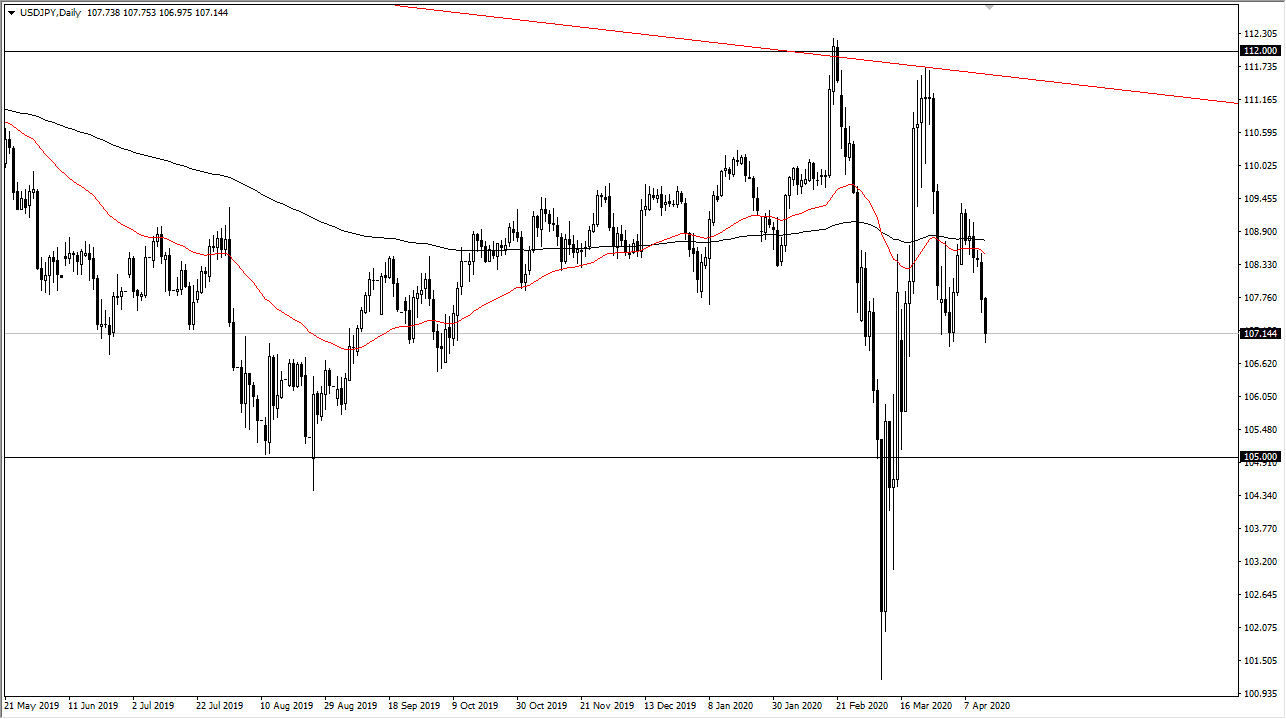

The US dollar has fallen against the Japanese yen during the trading session on Tuesday, reaching down towards the vital ¥107 level. This is an area that has been important more than once, and we bounced from there at the most recent swing low. If we break down below here, that could send this market down towards the ¥105 level, which is even more supportive based upon longer-term charting. I suspect that we very well could see something like that and perhaps a bigger bounce from down there. The US dollar has been hammered as of late, but I still think we are essentially in a huge range against the Japanese yen. Because of this, we could be looking at the market bouncing between ¥105 and ¥112 over the longer term. Clearly, the US dollar continues to get absolutely crushed, but one has to wonder how long that’s going to last.

The candlestick for the day does suggest that we probably have further downside, so I much more comfortable shorting this pair that I am buying it. However, a bounce from here could open up the door for a move higher, perhaps as high as the ¥109 level. I think at this point we are getting ready to make that decision at the ¥107 level, so we break down below there for more than an hour I would be selling this market. On the other hand, if we can break above the 190 and level though, then I think there’s a good chance that this market goes looking towards the ¥111 level, perhaps making a bit of a pitstop at the ¥110 level.

With the Federal Reserve doing everything they can to kill the US dollar, it’s possible that we could continue to see a bit of US dollar weakness but eventually people are going to need dollars, and I do think that longer term we probably have a completely different Outlook than what I’m looking at here. With that, I cautiously pessimistic when it comes to this pair, but I also recognize that we have a clear 200 point range level that we are trading in right now, followed by another 200 points once we finally break out. Volatility will continue to be extraordinarily high, and of course cause a lot of headaches for Forex traders around the world. Keep your position size extraordinarily small.