Two days after an empty economic calendar of any important economic releases, we will have today a great interest in retail sales and industrial production figures from the United States of America, which is extending the closing period of the American economy to contain the spread of the Coronavirus. Prior to the data announcements, the USD/JPY continues its sharp losses which pushed it towards the 106.97 support before settling around the 107.20 level in the beginning of today’s trading. Its losses were supported by the violent retreat of the USD amid prevailing optimism in the global markets of the Coronavirus reaching its peak, which confirms the success of the containment plans carried out by the governments.

The US dollar was recently abandoned as a safe haven as the coronary virus outbreak increased expectations that the US central bank may announce more stimulus plans soon. The risk appetite is increasing slightly, amid reports that the infection curve is flattening in many parts of the world, which has contributed little to the dollar's decline. Accordingly, the dollar index, DXY, fell to 98.83, and lost more than 0.5% yesterday.

The stronger than expected Chinese trade data also affected the dollar. As China's imports increased by -2.4% year on year, exceeding expectations for a decrease of -7%. Imports decreased by 2.4% in February. Chinese exports fell 3.5%, compared to expectations of 12.8%. Exports fell 15.9% in February. The trade surplus for this month narrowed to 130 billion Yuan from 158.5 billion Yuan in February.

Some European countries have begun to ease the restrictions of the closure, as the governments of Italy and Spain took initial steps this week to return some workers to their jobs and allow some stores to reopen their doors. Germany is also studying the terms of the deregulation, while there are indications that the UK will extend the closing period for another three weeks until at least May 7.

Currency traders also absorbed data related to US import and export prices. As import prices in the U.S. showed a sharp drop in March, according to a report released by the Labor Department on Tuesday, while export prices fell sharply. The ministry said that import prices fell - 2.3% in March after a revised - 0.7% revised in February. The decline reflects the largest monthly drop in import prices since January 2015.

Economists had expected import prices to drop - 1.7%, compared to a 0.5% decrease drop in the previous month. The biggest drop in import prices came with fuel import prices falling by -26.8% in March after falling by -9% in February. Oil and natural gas prices also showed significant decreases.

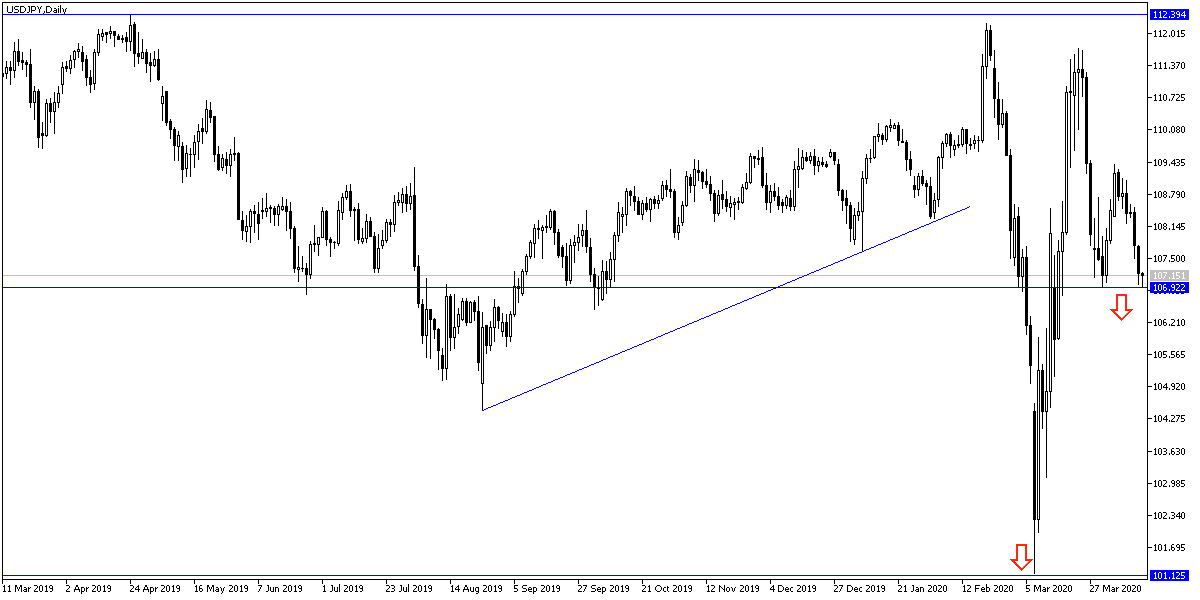

According to the technical analysis of the pair: The general USD/JPY trend on the daily chart is getting stronger towards the decline as long as it remains stable below the 108.00 support. It is the closest to new buying levels, the best of which are 106.75, 105.90 and 105.00 respectively. Long term target is 110.75 and short term target is 109.30 and stop out is at 105.00. The trend turning upward again will depend on the pair's move towards the 110.00 psychological resistance.

As for the economic calendar data today: The most important interest will be on the results of the U.S retail sales numbers and industrial production rate.