The USD/JPY is trying to maintain the 109.00 resistance to be able to move within its newly formed bullish channel. The updated figures for the number of coronavirus cases and deaths in the world economies are still a very influential factor on the pair’s performance. Both the dollar and the Yen are safe haven assets for investors in times of uncertainty. The lack of important US economic releases since the beginning of this week’s trading was a factor in the limited performance of the pair.

As for the continuation of the US stimulus plans to face the catastrophic economic shock from the Corona epidemic, the minutes of the Federal Reserve's monetary policy meetings in March showed that some participants favored a lower interest rate cut rather than a full percentage rate cut at the March 15 meeting. The minutes added that some of the participants in the meeting preferred to reduce interest rates by 50 basis points, noting that such a decision would provide support to the economy in the face of the coronavirus outbreak while maintaining the ability of the Federal Reserve to reduce interest rates again in the event of a worsen economic expectations deterioration.

Participants also noted that a 100 basis point cut in interest rates less than two weeks after the emergency 50 basis point cut, has the risk of sending a very negative signal about the economic outlook.

However, the US Central Bank Board eventually voted to cut interest rates by 100 basis points to a range from zero to 0.25 percent, indicating a possible short-term drop in economic activity due to the virus outbreak and a very large degree of uncertainty about the length and severity of this drop.

The President of the Federal Reserve Bank of Cleveland Loretta J. Mester, voted against the measure, preferring to reduce the federal funds rate target range to 0.5 to 0.75 percent. The minutes indicated that Mister was fully supportive of all measures taken to enhance the smooth functioning of markets, and the flow of credit to families and companies.

Regarding the economic outlook, the meeting participants presented several alternative scenarios regarding the possible economic activity behavior in the second half of the year. The Fed noted that these scenarios differed from each other in the assumed length and severity of the disruptions in economic activity caused by the coronavirus.

Many participants suggested that the negative effects on economic activity would not necessarily be as long-term as those associated with the financial crisis of the previous decade. They stressed on the temporary nature of the economic activity shock, the fact that the shock arose in the non-financial sector, and the health status of the American banking system.

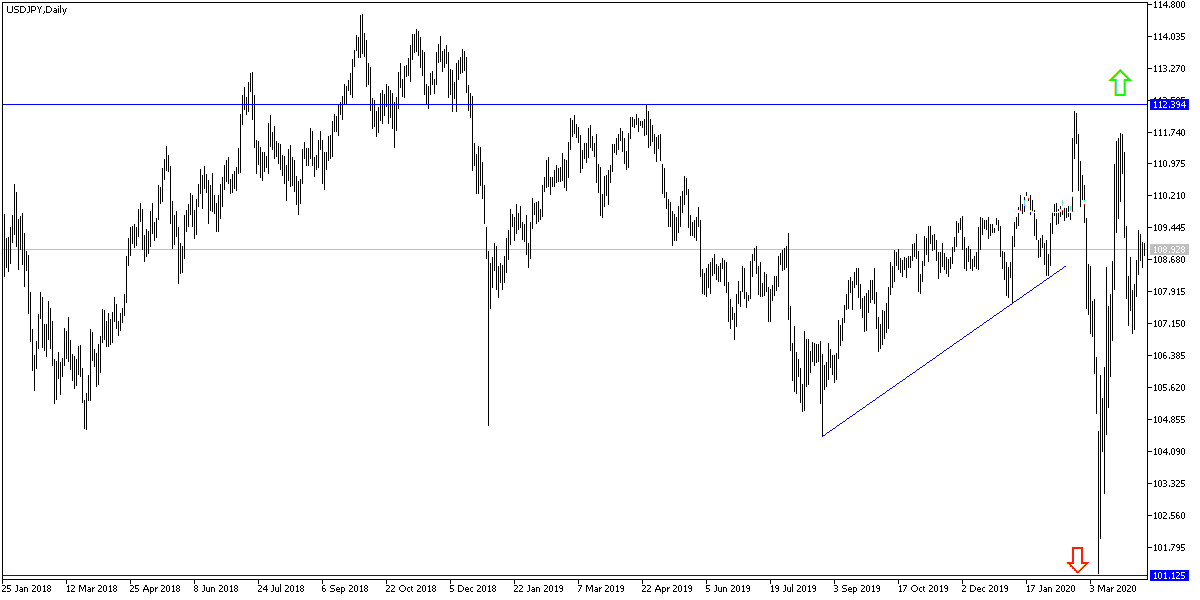

According to the technical analysis of the pair: the USD/JPY is in a neutral position now and the 110.00 psychological resistance will remain in support of stronger control of the bulls on the performance. And as I expected before, I now confirm that the move below the 108.00 psychological support will increase the bearish momentum of the pair. Weak liquidity in financial markets, again, will be in favor of stronger gains for the US dollar.

As for the economic calendar data: All focus will be on the US data, where jobless claims, PPI and Michigan consumer confidence data will be released.