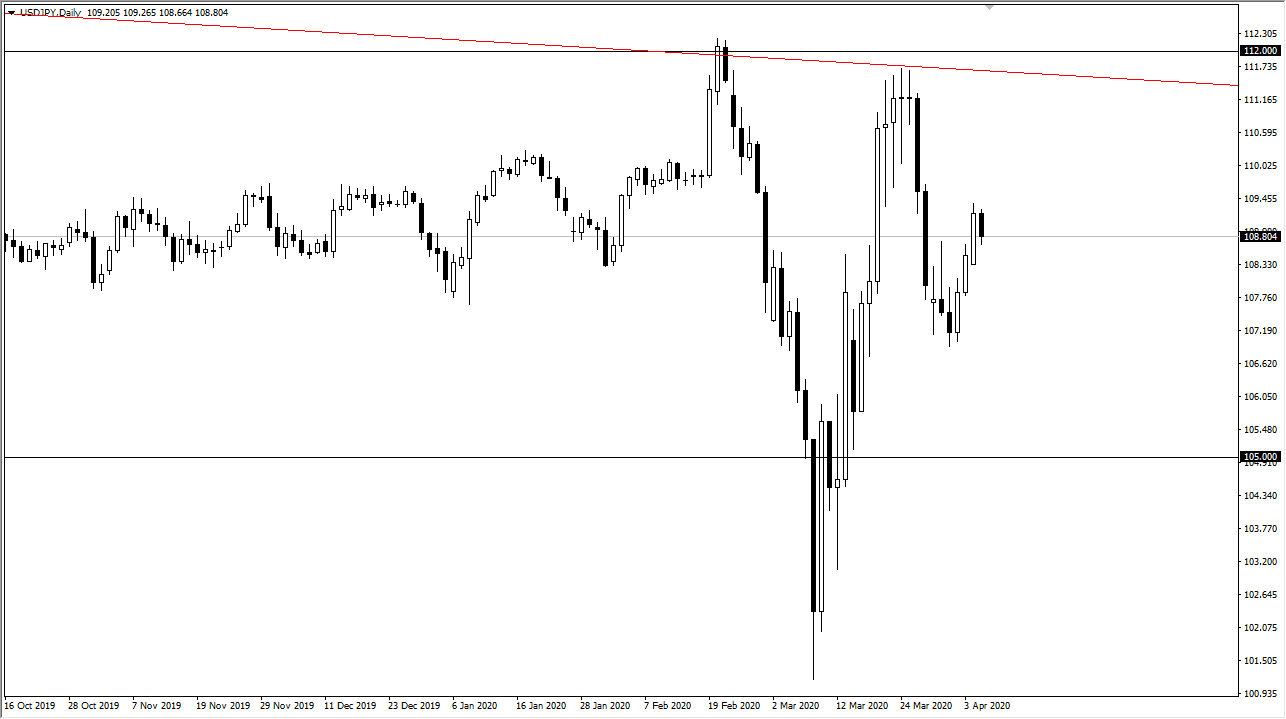

The US dollar pulled back a bit against the Japanese yen during the trading session on Tuesday, as the ¥109.50 level has been a bit too much to overcome. Because of this, the US dollar did pull back a bit, even though the stock markets rallied. Typically, this pair will move right along with the S&P 500, but it has shown signs of divergence from that recently. It should be noted that we are getting close to the top of the overall range and that something that should probably be paid attention to. The ¥110 level is the beginning of massive resistance that extends all the way to at least the ¥112 level. Don’t get me wrong, I’m not saying we can’t get through that level, but there is an entire area that the sellers could get involved in.

On the other hand, the ¥107 level underneath could be massive support, so if we were to break down below it, it would be a sell signal to reach down towards the ¥105 level. At this point, it would probably take nothing but a negative headline to make something like that happen, because quite frankly the markets have been very skittish. This is a market that continues to be very noisy, and as a result it’s very likely to continue being a difficult market to trade. I would keep my position size relatively small, because we could clearly see some type of headline risk that comes into play and causes chaos in this pair.

Lately, I have been using the USD/JPY pair as a secondary signal to all JPY related currency pairs. Ultimately, the market falling from here could send the other GPI related currency pairs lower as well. This gives a bit of a signal or better yet confirmation of potential setups in pairs like GBP/JPY, EUR/JPY, and so on. At this point, I favor the downside more than the up, but I also recognize that there has been a lot of resilience when it comes to the US dollar over the last several months and therefore it is going to be difficult to go against the US dollar in favor of the yen, at least in comparison to something along the lines of the AUD/JPY pair which features a commodity currency against a safety currency at this point, it’s probably best to stay somewhat neutral in this particular pair.