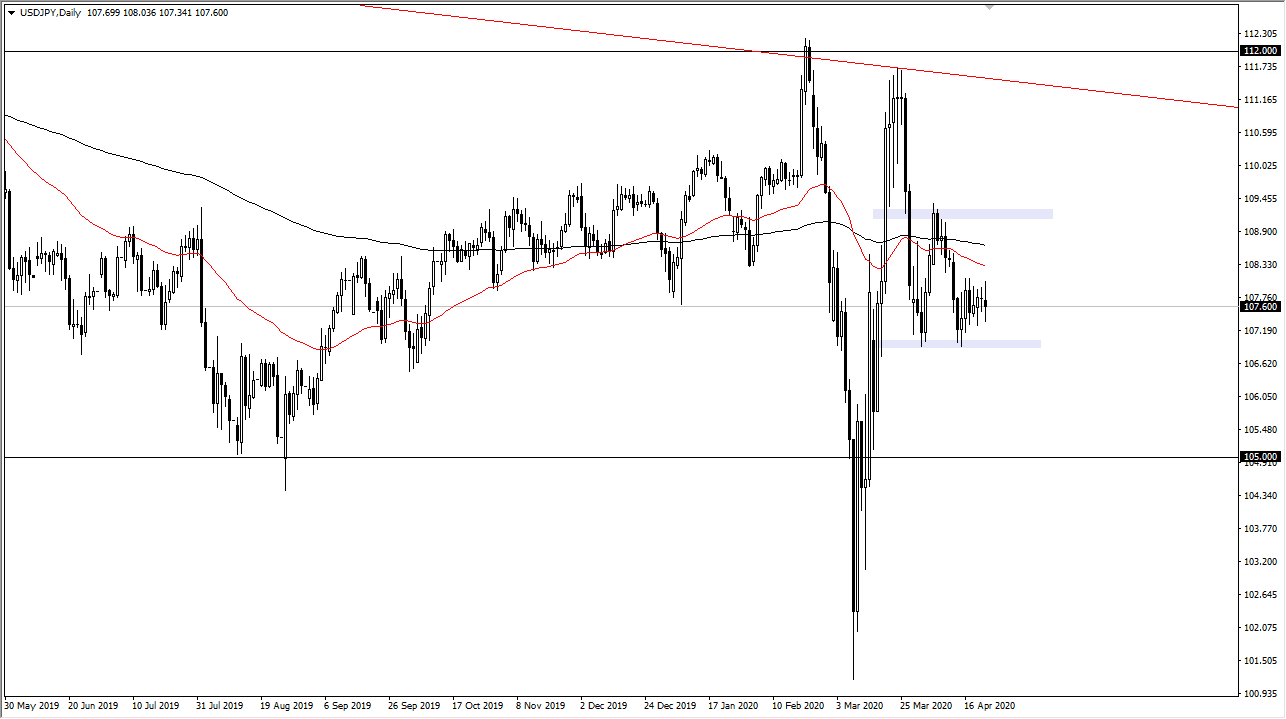

The US dollar has gone back and forth during the trading session on Thursday, as we continue to see a lot of noise around the ¥108 level. Just below, the ¥107 level offers a lot of support, due to the fact that we have recently formed a bit of a double bottom there. If we can break down below that level, it is highly likely that the market can continue to go down to the ¥105 level given enough time. This market has recently been grinding back and forth in a 200 point range, so it makes sense that if we break out of this 200 point range, we should continue to make that size of the move.

Ultimately, if we break above the top of the range it is likely that we will go 200 pips to the upside and go looking towards the ¥111 level. That is basic technical analysis and I think that is probably how things will play out. I do not like the idea of trying to get too cute with this pair, and quite frankly it is not worth my time to trade right now. That being said though, it is highly likely that we can see this chart as more or less an indicator for Japanese yen strength or weakness, so therefore we can take advantage of that. If this pair starts to fall, then you might want to short AUD/JPY, GBP/JPY, or other such pairs. On the other hand, this market rallies then it might be more of a “buy the US dollar” type situation. It might be a scenario where you can buy the US dollar against other currencies.

That being said though, once we finally break out, we should get a bit of a significant trade. Until then, this is a difficult scenario to trade in and therefore I am simply using it as a gauge of the moment, but I do think it is given enough time that we will be able to trade this market nicely. You have to be overly cautious about trying to put too much faith into a move. That being said, it looks as if the market is simply falling asleep and that makes quite a bit of sense considering that the currencies are both considered to be “safety currency”, and therefore it’s worth noticing that there is no clear winner, and that tells you there is still a lot of underlying concern out there.