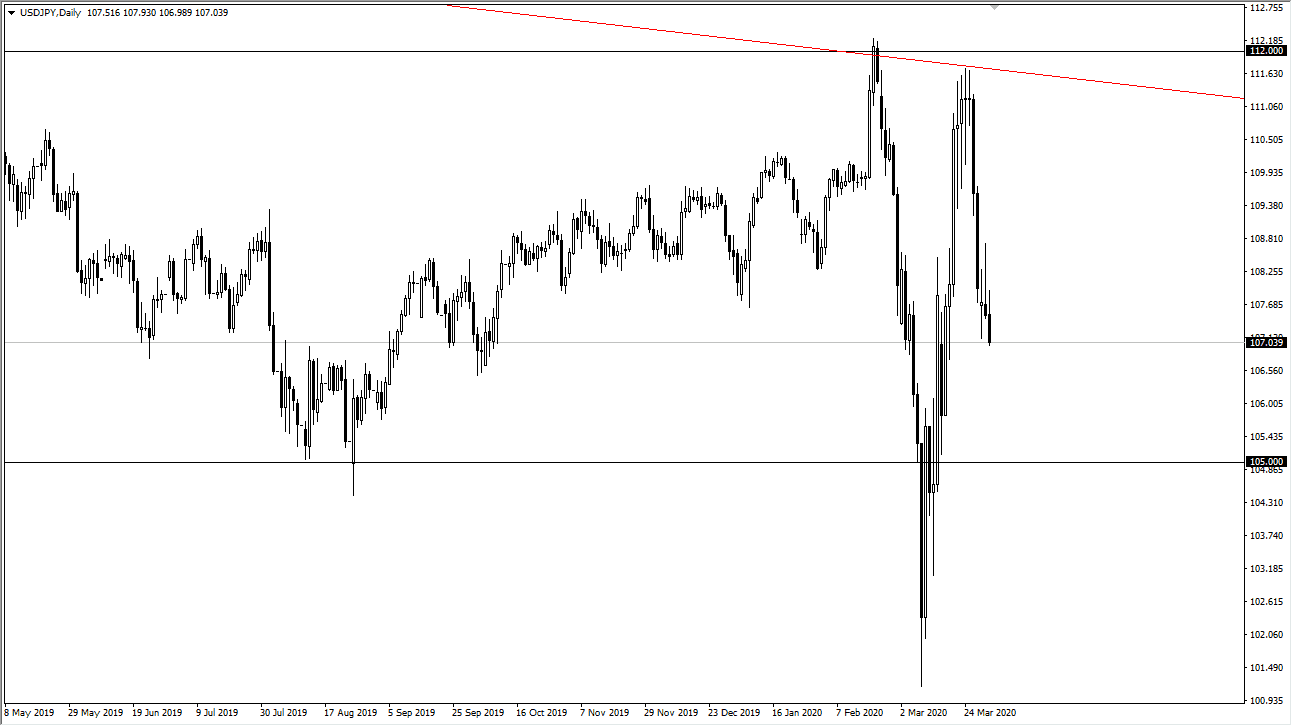

The US dollar initially tried to rally against the Japanese yen during trading on Wednesday, as we have fallen towards the ¥107 level.The risk appetite around the world seems to be struggling in this means that we are more than likely going to continue to reach down towards the ¥105 level now that we have broken the binary candlestick from the Monday session, formed a shooting star on Tuesday, and have broken even lower. It seems a bit difficult to imagine the global risk appetite is suddenly going to take off to the upside, so I believe it is only a matter of time before the market really starts to break down significantly. I think we continue to see a lot of concern out there and that will be a major driver of strength for the Japanese yen itself.

Rallies at this point are to be sold, as I believe we continue to go back and forth in the overall consolidation area that we have been in. The ¥105 level could be somewhat supportive, but if we break down below there then it opens up the door to the 102 level. I don’t like the idea of trying to get too cute with this pair, as it is widening its overall range, wiping out trading accounts along the way. There has been unimaginable damage done to retail and industrial traders scratch industrial traders institutional traders alike, so one has to think that volumes are dropping off.

It seems as if the selling accelerated later in the day, meaning that bigger money was leaving the markets. There is nothing on this chart that looks remotely healthy, so therefore one would have to think that the safety of the Japanese yen will continue to look quite attractive to longer-term traders. The sellers continue to run this market, lease for this week but with the jobs number coming out on Friday we could turn around in the blink of an eye. Be cautious and keep your trading position relatively small to make sure that you don’t run into too much trouble. With this, I believe it is only a matter of time before we get some type of landslide. Many of the professional traders I know are being bothered with trying to trade the yen right now as it is far too out-of-control.