The US dollar has rallied against the Japanese yen during the trading session on Thursday, breaking much higher after getting horrific initial jobless claims. In the United States, the initial jobless claims figure was over 6 million, twice what was anticipated. Unemployment claims of course are a leading indicator of economic activity, so it certainly shows that the US is going to slow down even further than people may had anticipated.

That being said, the market did exactly what you would expect it not to do: it rallied. The Japanese yen is typically used as a safety currency, but at this point it looks as if the US dollar continues to attract a certain amount of flow. The US stock markets also turned around and show signs of life so perhaps this is simply a market that is trying to follow the S&P 500. Furthermore, one would have to worry about the Non-Farm Payroll figures coming out on Friday, which typically have a major influence on this currency pair.

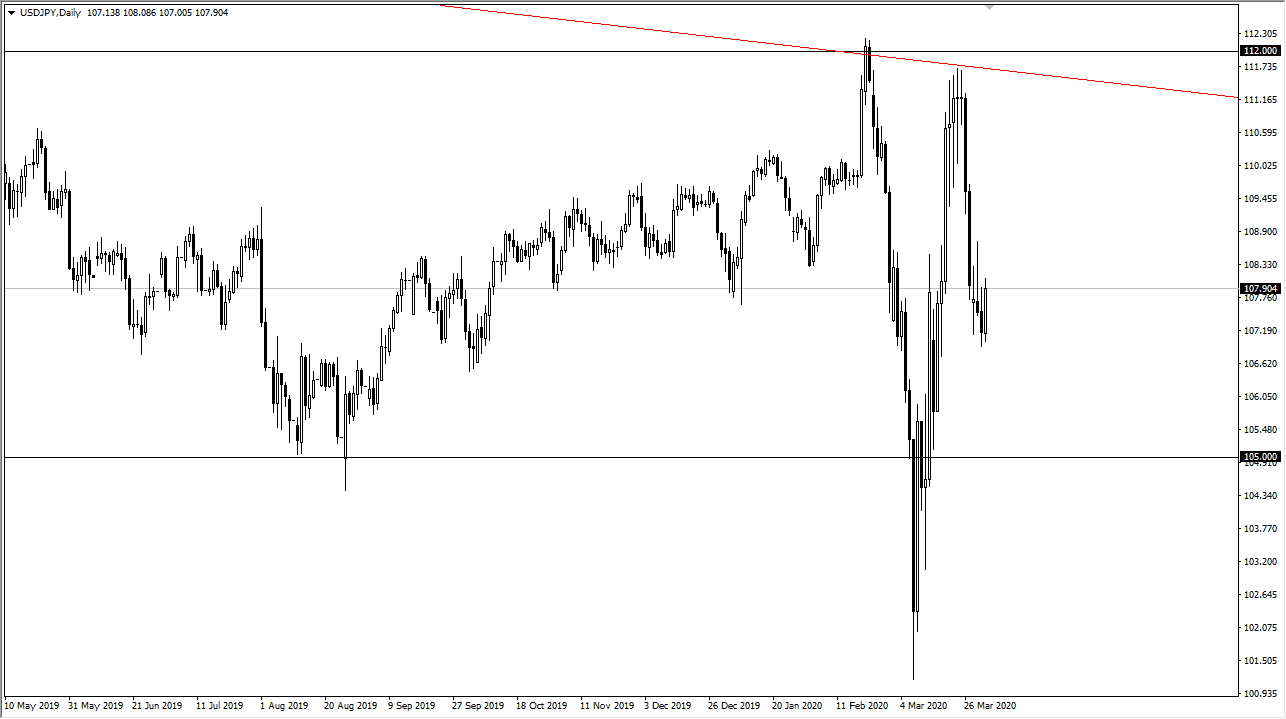

I think at this point it is probably much easier to look at the longer-term charts and try to discern which position you should be in. The market has been back and forth so drastically, that it’s almost impossible to imagine a scenario that the market is easy to trade here, and looking at this chart you can also guesstimate that somewhere in this area we are essentially near the “fair value area” as it is between the highs and the lows of this most recent couple of moves. With that in mind, I believe that this is a market that is trying to reprice risk in general, and it really doesn’t know what to do. After all, the coronavirus numbers continue to be a major issue in the United States, but Japan is also suffering. With the global markets out there slowing down I think this is a pair that is probably going to be awesome possible to trade with any type of confidence if you use your normal trading systems.

After the week is over, perhaps there may be some clarity but at this point it’s probably best to leave this pair alone as we are still in the middle of the massive swings that we have seen over the last couple of weeks. That being said, if you do choose to trade the Japanese yen, you may want to do it against other currencies such as the Australian dollar or British pound.