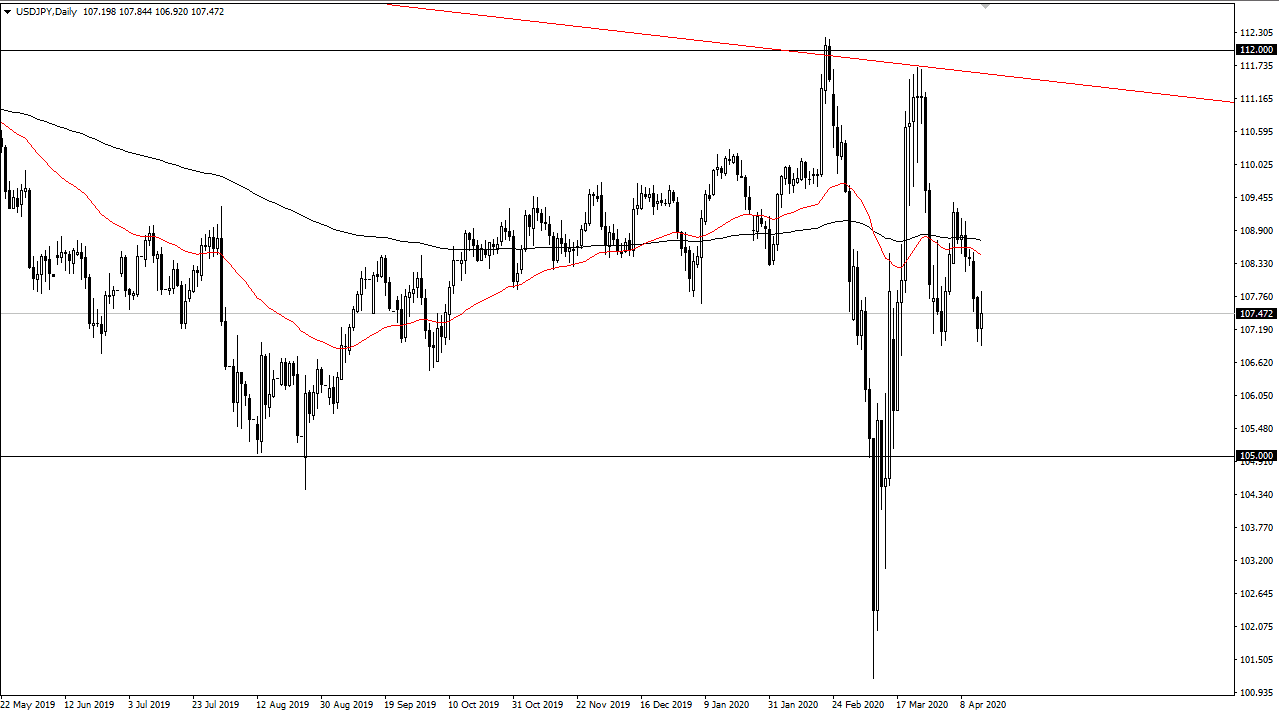

The US dollar has initially pulled back a bit to kick off the trading session on Wednesday, reaching towards the ¥107 level. At this point, the ¥107 level looks to be somewhat supportive, but at the same time we have seen extreme amounts of volatility in the currency pair as there has been so much in the way of noise when it comes to the currency pair. I think overall if we can break down below the ¥107 level it will open up the door to the ¥105 level, just as I suggested yesterday. On the other hand, if we turn around and rally from here, I suspect that the ¥109 level above will be the initial target. The market does look like it’s trying to hold in this overall 200 point range, and you can think of it more or less as a rectangle, meaning that you should get the same move as the height of the consolidation. In other words, we break above the ¥109 level, then it’s likely that we go to the ¥111 level.

I think one of the biggest things about this pair that you should be aware of right now is that it’s trying to figure out its new range. In the short term, I believe that the 200 point range that we are in right now is that potential consolidation area, but it should be noted that the most recent high was lower than the one before it. The question now is whether or not the low that we could be forming right now will be at the same level, or will it break down below here to go finding support at ¥105? At this point, you can make a case for either situation as the Japanese yen is most certainly a safety currency, right along with the US dollar.

That’s going to be the trick of this pair: differentiating which safety currency the market is running to. There is a US dollar shortage, and that of course could play out as well but at the same time the Japanese yen is so loved by those looking to avoid serious risk. Pay attention to the stock markets, if the rollover again like they did during the day on Wednesday, that could be the straw that breaks the camel’s back underneath. On the other hand, if we get some type of big rally, we may see a bounce towards the ¥109 level.