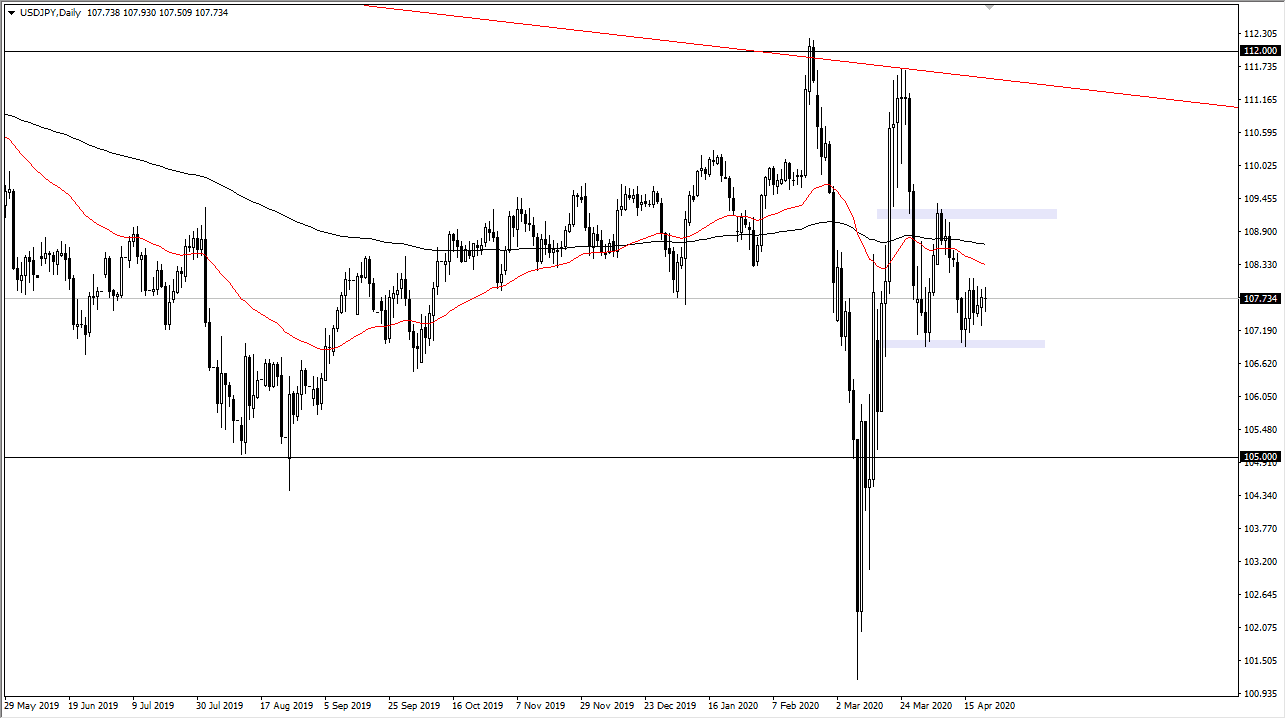

The US dollar has gone back and forth during the trading session on Wednesday, as we continue to grind just below the ¥108 level. If you are looking for a place for money to die, this might be a great market to do that. It is not necessarily that you are going to lose money, it is just that you are going to make any either. This is a market that has simply dropped to a volatility of almost 0 due to the fact that there is a major “risk off” attitude out there, and of course both of these currencies are considered to be safety currencies. In other words, money tends the flow towards the US and Japan in the scenarios.

The market has been bouncing around between the ¥107 level on the bottom and the ¥109 level. Overall, I believe that we are stuck in this range and will be for quite some time, so I have been using this currency pair as a bit of an indicator more than anything else. I believe that the pair is probably best used as a proxy for Japanese yen strength more than anything else. In other words, if the USD/JPY pair falls, then if you are looking to short another currency such as the Australian dollar, you will probably be looking to short the AUD/JPY pair because it will outperform as the Japanese yen is stronger in that scenario. Alternately, if the USD/JPY is starting to rally, then it shows that there is US dollar strength and therefore you would want to short the AUD/USD pair.

Beyond that, it is exceedingly difficult to use this chart for anything other than some type of proxy for relative strength. The market seems to be grinding to a halt, because there is going to be a lot of concerns when it comes to economic growth around the world, and both of these currencies should continue to be extremely attractive for traders. Ultimately, I think it is only a matter of time before we see some type of significant move, but until that happens this is a market that you simply cannot ignore and therefore you have to be on the sidelines and wait for a bit more clarity. At this point, the market is simply acting as a technical indicator, but eventually will get some type of break out.